Hedge funds don’t get the respect they used to get. Nowadays investors prefer passive funds over actively managed funds. One thing they don’t realize is that 100% of the passive funds didn’t see the coronavirus recession coming, but a lot of hedge funds did. Even we published an article near the end of February and predicted a US recession. Think about all the losses you could have avoided if you sold your shares in February and bought them back at the end of March.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, let’s examine the smart money sentiment towards Lindsay Corporation (NYSE:LNN).

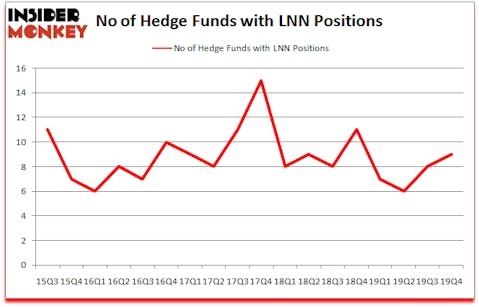

Lindsay Corporation (NYSE:LNN) shareholders have witnessed an increase in hedge fund interest recently. Our calculations also showed that LNN isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

David Harding of Winton Capital Management

We leave no stone unturned when looking for the next great investment idea. For example, this investor can predict short term winners following earnings announcements with high accuracy, so we check out his stock picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to view the fresh hedge fund action regarding Lindsay Corporation (NYSE:LNN).

How are hedge funds trading Lindsay Corporation (NYSE:LNN)?

At Q4’s end, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from the third quarter of 2019. The graph below displays the number of hedge funds with bullish position in LNN over the last 18 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Impax Asset Management held the most valuable stake in Lindsay Corporation (NYSE:LNN), which was worth $84.3 million at the end of the third quarter. On the second spot was Royce & Associates which amassed $83.1 million worth of shares. SG Capital Management, Renaissance Technologies, and GAMCO Investors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position SG Capital Management allocated the biggest weight to Lindsay Corporation (NYSE:LNN), around 3.43% of its 13F portfolio. Impax Asset Management is also relatively very bullish on the stock, setting aside 0.94 percent of its 13F equity portfolio to LNN.

As one would reasonably expect, key money managers have jumped into Lindsay Corporation (NYSE:LNN) headfirst. Winton Capital Management, managed by David Harding, established the largest position in Lindsay Corporation (NYSE:LNN). Winton Capital Management had $1.4 million invested in the company at the end of the quarter. Donald Sussman’s Paloma Partners also initiated a $0.8 million position during the quarter. The only other fund with a new position in the stock is Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks similar to Lindsay Corporation (NYSE:LNN). We will take a look at Controladora Vuela Compania de Aviacion, S.A.B. de C.V. (NYSE:VLRS), 3D Systems Corporation (NYSE:DDD), Hanger, Inc. (NYSE:HNGR), and OneSpaWorld Holdings Limited (NASDAQ:OSW). This group of stocks’ market values resemble LNN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VLRS | 11 | 114895 | 3 |

| DDD | 19 | 48902 | 6 |

| HNGR | 15 | 82071 | -1 |

| OSW | 11 | 114086 | 3 |

| Average | 14 | 89989 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $90 million. That figure was $202 million in LNN’s case. 3D Systems Corporation (NYSE:DDD) is the most popular stock in this table. On the other hand Controladora Vuela Compania de Aviacion, S.A.B. de C.V. (NYSE:VLRS) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Lindsay Corporation (NYSE:LNN) is even less popular than VLRS. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but managed to beat the market by 12.9 percentage points. A small number of hedge funds were also right about betting on LNN, though not to the same extent, as the stock returned -9.2% during the same time period and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.