In this article you are going to find out whether hedge funds think Honeywell International Inc. (NYSE:HON) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

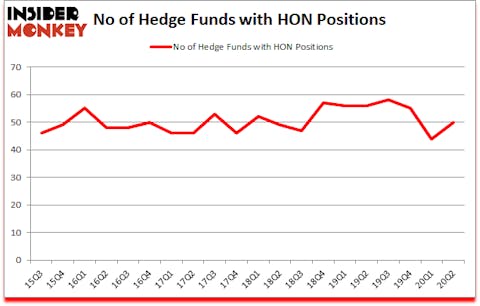

Honeywell International Inc. (NYSE:HON) has seen an increase in enthusiasm from smart money of late. Honeywell International Inc. (NYSE:HON) was in 50 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 58. There were 44 hedge funds in our database with HON holdings at the end of March. Our calculations also showed that HON isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 56 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 34% through August 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Ryan Tolkin, CIO of Schonfeld Strategic Advisors

At Insider Monkey we scour multiple sources to uncover the next great investment idea. We go through lists like the 10 best high dividend stocks to buy to identify solid dividend stocks trading at rock bottom prices. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind we’re going to take a glance at the latest hedge fund action regarding Honeywell International Inc. (NYSE:HON).

What have hedge funds been doing with Honeywell International Inc. (NYSE:HON)?

Heading into the third quarter of 2020, a total of 50 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards HON over the last 20 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, D. E. Shaw’s D E Shaw has the biggest position in Honeywell International Inc. (NYSE:HON), worth close to $290.3 million, corresponding to 0.3% of its total 13F portfolio. The second largest stake is held by Millennium Management, led by Israel Englander, holding a $182.9 million position; 0.3% of its 13F portfolio is allocated to the stock. Other peers that hold long positions encompass Ric Dillon’s Diamond Hill Capital, John Overdeck and David Siegel’s Two Sigma Advisors and Mario Gabelli’s GAMCO Investors. In terms of the portfolio weights assigned to each position Pittencrieff Partners – Gabalex Capital allocated the biggest weight to Honeywell International Inc. (NYSE:HON), around 8.19% of its 13F portfolio. Swift Run Capital Management is also relatively very bullish on the stock, setting aside 3.9 percent of its 13F equity portfolio to HON.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Sandbar Asset Management, managed by Michael Cowley, created the most outsized position in Honeywell International Inc. (NYSE:HON). Sandbar Asset Management had $6.2 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $5.4 million position during the quarter. The following funds were also among the new HON investors: Seth Cogswell’s Running Oak Capital, Matthew Hulsizer’s PEAK6 Capital Management, and Michael Gelband’s ExodusPoint Capital.

Let’s also examine hedge fund activity in other stocks similar to Honeywell International Inc. (NYSE:HON). These stocks are TOTAL SE (NYSE:TOT), Gilead Sciences, Inc. (NASDAQ:GILD), Royal Bank of Canada (NYSE:RY), United Parcel Service, Inc. (NYSE:UPS), Anheuser-Busch InBev SA/NV (NYSE:BUD), HSBC Holdings plc (NYSE:HSBC), and JD.Com Inc (NASDAQ:JD). This group of stocks’ market valuations match HON’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TOT | 19 | 861496 | 7 |

| GILD | 68 | 2286230 | -8 |

| RY | 16 | 237643 | 0 |

| UPS | 37 | 781926 | -11 |

| BUD | 17 | 860874 | 0 |

| HSBC | 10 | 384518 | -4 |

| JD | 87 | 11211241 | -3 |

| Average | 36.3 | 2374847 | -2.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.3 hedge funds with bullish positions and the average amount invested in these stocks was $2375 million. That figure was $1448 million in HON’s case. JD.Com Inc (NASDAQ:JD) is the most popular stock in this table. On the other hand HSBC Holdings plc (NYSE:HSBC) is the least popular one with only 10 bullish hedge fund positions. Honeywell International Inc. (NYSE:HON) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for HON is 61.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 30% in 2020 through October 23rd and still beat the market by 21 percentage points. Hedge funds were also right about betting on HON as the stock returned 22.1% since the end of Q2 (through 10/23) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Honeywell International Inc (NASDAQ:HON)

Follow Honeywell International Inc (NASDAQ:HON)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.