Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Welbilt, Inc. (NYSE:WBT).

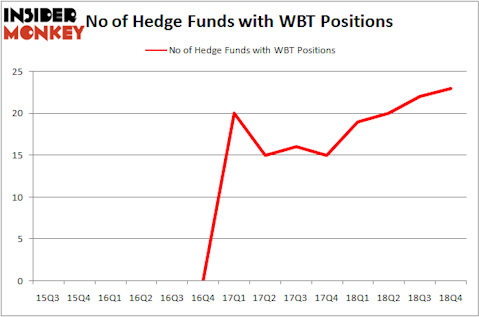

Welbilt, Inc. (NYSE:WBT) has seen an increase in activity from the world’s largest hedge funds recently. Our calculations also showed that WBT isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are perceived as underperforming, outdated financial tools of years past. While there are over 8000 funds trading at the moment, We choose to focus on the masters of this group, approximately 750 funds. It is estimated that this group of investors command most of the hedge fund industry’s total capital, and by monitoring their top picks, Insider Monkey has revealed many investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to go over the latest hedge fund action surrounding Welbilt, Inc. (NYSE:WBT).

What does the smart money think about Welbilt, Inc. (NYSE:WBT)?

At the end of the fourth quarter, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from the second quarter of 2018. On the other hand, there were a total of 19 hedge funds with a bullish position in WBT a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Robert Joseph Caruso’s Select Equity Group has the largest position in Welbilt, Inc. (NYSE:WBT), worth close to $142.3 million, accounting for 1.1% of its total 13F portfolio. The second largest stake is held by Carl Icahn of Icahn Capital LP, with a $112 million position; 0.5% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors with similar optimism consist of Ian Simm’s Impax Asset Management, Jeffrey Gates’s Gates Capital Management and Steven Boyd’s Armistice Capital.

Consequently, key money managers were breaking ground themselves. Select Equity Group, managed by Robert Joseph Caruso, assembled the most valuable call position in Welbilt, Inc. (NYSE:WBT). Select Equity Group had $26.5 million invested in the company at the end of the quarter. Steven Boyd’s Armistice Capital also initiated a $19.5 million position during the quarter. The other funds with new positions in the stock are Ric Dillon’s Diamond Hill Capital, Nick Niell’s Arrowgrass Capital Partners, and Jim Simons’s Renaissance Technologies.

Let’s now take a look at hedge fund activity in other stocks similar to Welbilt, Inc. (NYSE:WBT). These stocks are LegacyTexas Financial Group Inc (NASDAQ:LTXB), TopBuild Corp (NYSE:BLD), Alexander’s, Inc. (NYSE:ALX), and Tri Pointe Group Inc (NYSE:TPH). This group of stocks’ market valuations resemble WBT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LTXB | 12 | 65493 | -2 |

| BLD | 14 | 91036 | -4 |

| ALX | 6 | 54780 | -2 |

| TPH | 15 | 128152 | -2 |

| Average | 11.75 | 84865 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $85 million. That figure was $508 million in WBT’s case. Tri Pointe Group Inc (NYSE:TPH) is the most popular stock in this table. On the other hand Alexander’s, Inc. (NYSE:ALX) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Welbilt, Inc. (NYSE:WBT) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on WBT as the stock returned 53.4% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.