Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 13.1% in the 2.5 months of 2019 (including dividend payments). Conversely, hedge funds’ 15 preferred S&P 500 stocks generated a return of 19.7% during the same period, with 93% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Iridium Communications Inc. (NASDAQ:IRDM).

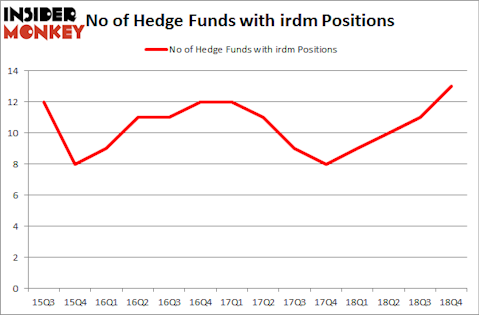

Iridium Communications Inc. (NASDAQ:IRDM) investors should pay attention to an increase in enthusiasm from smart money in recent months. IRDM was in 13 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 11 hedge funds in our database with IRDM positions at the end of the previous quarter. Our calculations also showed that irdm isn’t among the 30 most popular stocks among hedge funds.

Today there are numerous indicators investors have at their disposal to size up publicly traded companies. A duo of the most under-the-radar indicators are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can beat the S&P 500 by a very impressive margin (see the details here).

We’re going to take a look at the fresh hedge fund action encompassing Iridium Communications Inc. (NASDAQ:IRDM).

What does the smart money think about Iridium Communications Inc. (NASDAQ:IRDM)?

At the end of the fourth quarter, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from the second quarter of 2018. On the other hand, there were a total of 9 hedge funds with a bullish position in IRDM a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Iridium Communications Inc. (NASDAQ:IRDM), with a stake worth $46.8 million reported as of the end of September. Trailing Renaissance Technologies was Cloverdale Capital Management, which amassed a stake valued at $14.3 million. GAMCO Investors, Royce & Associates, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, some big names were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, established the most valuable position in Iridium Communications Inc. (NASDAQ:IRDM). Citadel Investment Group had $1.7 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $0.5 million investment in the stock during the quarter. The only other fund with a new position in the stock is John A. Levin’s Levin Capital Strategies.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Iridium Communications Inc. (NASDAQ:IRDM) but similarly valued. We will take a look at Cactus, Inc. (NYSE:WHD), Travelport Worldwide Ltd (NYSE:TVPT), SITE Centers Corp. (NYSE:SITC), and El Paso Electric Company (NYSE:EE). All of these stocks’ market caps are similar to IRDM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WHD | 18 | 160146 | 1 |

| TVPT | 24 | 458103 | 1 |

| SITC | 15 | 91617 | 3 |

| EE | 23 | 274242 | 8 |

| Average | 20 | 246027 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $246 million. That figure was $113 million in IRDM’s case. Travelport Worldwide Ltd (NYSE:TVPT) is the most popular stock in this table. On the other hand SITE Centers Corp. (NYSE:SITC) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Iridium Communications Inc. (NASDAQ:IRDM) is even less popular than SITC. Hedge funds clearly dropped the ball on IRDM as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on IRDM as the stock returned 44.2% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.