Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Grupo Aval Acciones y Valores S.A. (NYSE:AVAL).

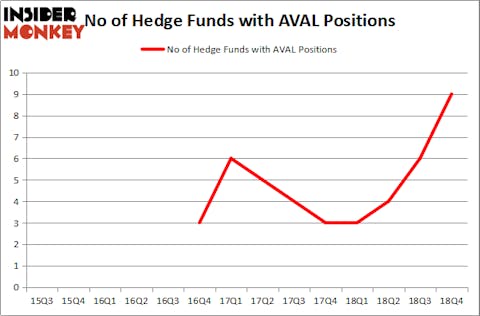

Is Grupo Aval Acciones y Valores S.A. (NYSE:AVAL) an outstanding investment now? Investors who are in the know are turning bullish. The number of bullish hedge fund bets advanced by 3 recently. Our calculations also showed that AVAL isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the fresh hedge fund action encompassing Grupo Aval Acciones y Valores S.A. (NYSE:AVAL).

How are hedge funds trading Grupo Aval Acciones y Valores S.A. (NYSE:AVAL)?

At the end of the fourth quarter, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from one quarter earlier. By comparison, 3 hedge funds held shares or bullish call options in AVAL a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the biggest position in Grupo Aval Acciones y Valores S.A. (NYSE:AVAL). Renaissance Technologies has a $6.6 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second most bullish fund manager is David Halpert of Prince Street Capital Management, with a $5.3 million position; 1.3% of its 13F portfolio is allocated to the stock. Some other peers with similar optimism encompass Israel Englander’s Millennium Management, D. E. Shaw’s D E Shaw and Paul Marshall and Ian Wace’s Marshall Wace LLP.

As industrywide interest jumped, key hedge funds have been driving this bullishness. Bailard Inc, managed by Thomas Bailard, created the biggest position in Grupo Aval Acciones y Valores S.A. (NYSE:AVAL). Bailard Inc had $0.7 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also initiated a $0.1 million position during the quarter. The only other fund with a new position in the stock is John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s check out hedge fund activity in other stocks similar to Grupo Aval Acciones y Valores S.A. (NYSE:AVAL). We will take a look at Tilray, Inc. (NASDAQ:TLRY), Brookfield Property Partners LP (NASDAQ:BPY), Pentair plc (NYSE:PNR), and NIO Inc. (NYSE:NIO). This group of stocks’ market caps resemble AVAL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TLRY | 8 | 203753 | -1 |

| BPY | 8 | 86346 | -3 |

| PNR | 25 | 645162 | 1 |

| NIO | 13 | 65823 | -1 |

| Average | 13.5 | 250271 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $250 million. That figure was $18 million in AVAL’s case. Pentair plc (NYSE:PNR) is the most popular stock in this table. On the other hand Tilray, Inc. (NASDAQ:TLRY) is the least popular one with only 8 bullish hedge fund positions. Grupo Aval Acciones y Valores S.A. (NYSE:AVAL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on AVAL as the stock returned 39.9% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.