At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

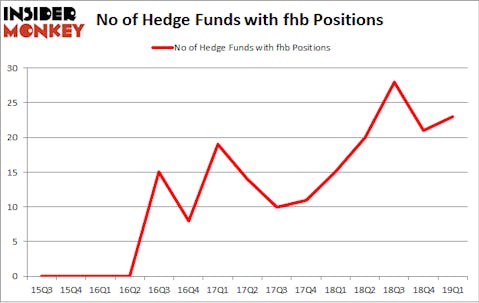

Is First Hawaiian, Inc. (NASDAQ:FHB) a healthy stock for your portfolio? The best stock pickers are getting more bullish. The number of long hedge fund positions moved up by 2 lately. Our calculations also showed that fhb isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the key hedge fund action regarding First Hawaiian, Inc. (NASDAQ:FHB).

Hedge fund activity in First Hawaiian, Inc. (NASDAQ:FHB)

At the end of the first quarter, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FHB over the last 15 quarters. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ken Griffin’s Citadel Investment Group has the largest position in First Hawaiian, Inc. (NASDAQ:FHB), worth close to $86.5 million, comprising less than 0.1%% of its total 13F portfolio. Coming in second is Two Sigma Advisors, led by John Overdeck and David Siegel, holding a $39.9 million position; 0.1% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors with similar optimism contain Phill Gross and Robert Atchinson’s Adage Capital Management, Israel Englander’s Millennium Management and Clint Carlson’s Carlson Capital.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most valuable position in First Hawaiian, Inc. (NASDAQ:FHB). Marshall Wace LLP had $13.4 million invested in the company at the end of the quarter. Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital also made a $4.4 million investment in the stock during the quarter. The other funds with brand new FHB positions are Benjamin A. Smith’s Laurion Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Thomas Bailard’s Bailard Inc.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as First Hawaiian, Inc. (NASDAQ:FHB) but similarly valued. These stocks are Allogene Therapeutics, Inc. (NASDAQ:ALLO), Regal Beloit Corporation (NYSE:RBC), Chimera Investment Corporation (NYSE:CIM), and Silicon Laboratories Inc. (NASDAQ:SLAB). This group of stocks’ market values resemble FHB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ALLO | 8 | 120844 | -2 |

| RBC | 17 | 130444 | 0 |

| CIM | 10 | 117502 | -1 |

| SLAB | 12 | 40386 | -5 |

| Average | 11.75 | 102294 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $102 million. That figure was $384 million in FHB’s case. Regal Beloit Corporation (NYSE:RBC) is the most popular stock in this table. On the other hand Allogene Therapeutics, Inc. (NASDAQ:ALLO) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks First Hawaiian, Inc. (NASDAQ:FHB) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately FHB wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FHB were disappointed as the stock returned -1.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.