Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

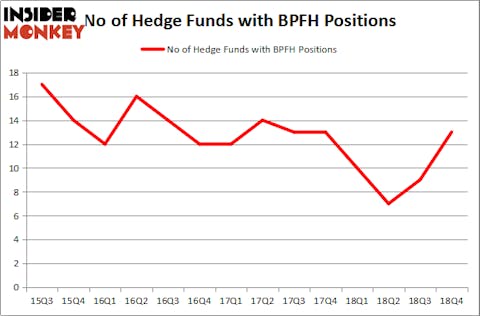

Is Boston Private Financial Hldg Inc (NASDAQ:BPFH) a buy, sell, or hold? Hedge funds are getting more bullish. The number of long hedge fund positions went up by 4 recently. Our calculations also showed that BPFH isn’t among the 30 most popular stocks among hedge funds. BPFH was in 13 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 9 hedge funds in our database with BPFH holdings at the end of the previous quarter.

To the average investor there are tons of gauges stock market investors use to assess stocks. A duo of the less utilized gauges are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the best hedge fund managers can outclass their index-focused peers by a very impressive margin (see the details here).

Let’s view the latest hedge fund action regarding Boston Private Financial Hldg Inc (NASDAQ:BPFH).

How are hedge funds trading Boston Private Financial Hldg Inc (NASDAQ:BPFH)?

At Q4’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 44% from the previous quarter. By comparison, 10 hedge funds held shares or bullish call options in BPFH a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in Boston Private Financial Hldg Inc (NASDAQ:BPFH), which was worth $24.6 million at the end of the fourth quarter. On the second spot was GAMCO Investors which amassed $5.6 million worth of shares. Moreover, Citadel Investment Group, Royce & Associates, and D E Shaw were also bullish on Boston Private Financial Hldg Inc (NASDAQ:BPFH), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key money managers have jumped into Boston Private Financial Hldg Inc (NASDAQ:BPFH) headfirst. GLG Partners, managed by Noam Gottesman, created the largest position in Boston Private Financial Hldg Inc (NASDAQ:BPFH). GLG Partners had $0.6 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also initiated a $0.5 million position during the quarter. The following funds were also among the new BPFH investors: Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Paul Tudor Jones’s Tudor Investment Corp.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Boston Private Financial Hldg Inc (NASDAQ:BPFH) but similarly valued. We will take a look at Xperi Corporation (NASDAQ:XPER), Systemax Inc. (NYSE:SYX), Addus Homecare Corporation (NASDAQ:ADUS), and AGM Group Holdings Inc. (NASDAQ:AGMH). All of these stocks’ market caps match BPFH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XPER | 15 | 108258 | -1 |

| SYX | 11 | 26036 | -3 |

| ADUS | 14 | 76200 | -4 |

| AGMH | 1 | 326 | 1 |

| Average | 10.25 | 52705 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $53 million. That figure was $52 million in BPFH’s case. Xperi Corporation (NASDAQ:XPER) is the most popular stock in this table. On the other hand AGM Group Holdings Inc. (AGMH) is the least popular one with only 1 bullish hedge fund positions. Boston Private Financial Hldg Inc (NASDAQ:BPFH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately BPFH wasn’t nearly as popular as these 15 stock and hedge funds that were betting on BPFH were disappointed as the stock returned 8.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.