Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 20 stock picks easily bested the broader market, at 18.7% compared to 12.1%, despite there being a few duds in there like Berkshire Hathaway (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

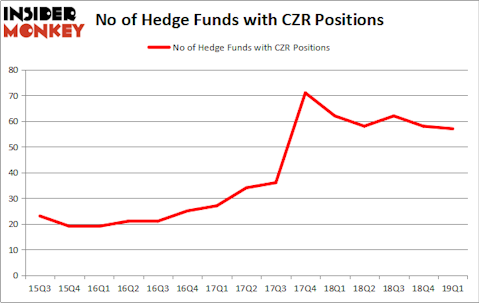

Caesars Entertainment Corp (NASDAQ:CZR) shareholders have witnessed a decrease in support from the world’s most elite money managers lately. Our calculations also showed that CZR isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the key hedge fund action regarding Caesars Entertainment Corp (NASDAQ:CZR).

Hedge fund activity in Caesars Entertainment Corp (NASDAQ:CZR)

Heading into the second quarter of 2019, a total of 57 of the hedge funds tracked by Insider Monkey were long this stock, a change of -2% from the fourth quarter of 2018. By comparison, 62 hedge funds held shares or bullish call options in CZR a year ago. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

The largest stake in Caesars Entertainment Corp (NASDAQ:CZR) was held by Icahn Capital LP, which reported holding $862.5 million worth of stock at the end of March. It was followed by Canyon Capital Advisors with a $674.2 million position. Other investors bullish on the company included HG Vora Capital Management, Soros Fund Management, and Silver Point Capital.

Since Caesars Entertainment Corp (NASDAQ:CZR) has experienced declining sentiment from hedge fund managers, logic holds that there is a sect of money managers that decided to sell off their entire stakes heading into Q3. Intriguingly, Doug Silverman and Alexander Klabin’s Senator Investment Group cut the biggest investment of the 700 funds monitored by Insider Monkey, comprising close to $135.8 million in stock, and David Gallo’s Valinor Management was right behind this move, as the fund sold off about $123.9 million worth. These moves are important to note, as aggregate hedge fund interest was cut by 1 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Caesars Entertainment Corp (NASDAQ:CZR) but similarly valued. These stocks are Ciena Corporation (NYSE:CIEN), Monolithic Power Systems, Inc. (NASDAQ:MPWR), Encompass Health Corporation (NYSE:EHC), and EPR Properties (NYSE:EPR). This group of stocks’ market caps are similar to CZR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CIEN | 30 | 510894 | 1 |

| MPWR | 20 | 172987 | -5 |

| EHC | 24 | 464510 | -6 |

| EPR | 17 | 136803 | -5 |

| Average | 22.75 | 321299 | -3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $321 million. That figure was $3150 million in CZR’s case. Ciena Corporation (NYSE:CIEN) is the most popular stock in this table. On the other hand EPR Properties (NYSE:EPR) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Caesars Entertainment Corp (NASDAQ:CZR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CZR as the stock returned 4.3% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.