In this article you are going to find out whether hedge funds think Donnelley Financial Solutions, Inc. (NYSE:DFIN) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

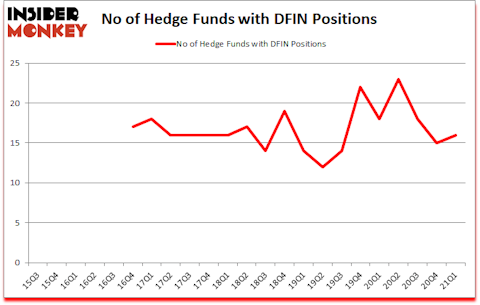

Donnelley Financial Solutions, Inc. (NYSE:DFIN) investors should pay attention to an increase in support from the world’s most elite money managers of late. Donnelley Financial Solutions, Inc. (NYSE:DFIN) was in 16 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 23. There were 15 hedge funds in our database with DFIN positions at the end of the fourth quarter. Our calculations also showed that DFIN isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 115 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Richard Driehaus of Driehaus Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, pet market is growing at a 7% annual rate and is expected to reach $110 billion in 2021. So, we are checking out the 5 best stocks for animal lovers. We go through lists like the 15 best Jim Cramer stocks to identify the next Tesla that will deliver outsized returns. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s take a look at the latest hedge fund action regarding Donnelley Financial Solutions, Inc. (NYSE:DFIN).

Do Hedge Funds Think DFIN Is A Good Stock To Buy Now?

At first quarter’s end, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from the previous quarter. On the other hand, there were a total of 18 hedge funds with a bullish position in DFIN a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Simcoe Capital Management, managed by Jeffrey Jacobowitz, holds the largest position in Donnelley Financial Solutions, Inc. (NYSE:DFIN). Simcoe Capital Management has a $91.8 million position in the stock, comprising 11.7% of its 13F portfolio. Sitting at the No. 2 spot is D E Shaw, led by D. E. Shaw, holding a $10.2 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining professional money managers that are bullish include Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Richard Driehaus’s Driehaus Capital and Parsa Kiai’s Steamboat Capital Partners. In terms of the portfolio weights assigned to each position Simcoe Capital Management allocated the biggest weight to Donnelley Financial Solutions, Inc. (NYSE:DFIN), around 11.69% of its 13F portfolio. Steamboat Capital Partners is also relatively very bullish on the stock, designating 1.16 percent of its 13F equity portfolio to DFIN.

With a general bullishness amongst the heavyweights, key money managers have been driving this bullishness. Driehaus Capital, managed by Richard Driehaus, established the largest position in Donnelley Financial Solutions, Inc. (NYSE:DFIN). Driehaus Capital had $7.8 million invested in the company at the end of the quarter. Parsa Kiai’s Steamboat Capital Partners also made a $3.9 million investment in the stock during the quarter. The other funds with brand new DFIN positions are Greg Eisner’s Engineers Gate Manager, Donald Sussman’s Paloma Partners, and Jay Petschek and Steven Major’s Corsair Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Donnelley Financial Solutions, Inc. (NYSE:DFIN) but similarly valued. These stocks are The Geo Group, Inc. (NYSE:GEO), Fanhua Inc. (NASDAQ:FANH), Lindblad Expeditions Holdings Inc (NASDAQ:LIND), Saul Centers Inc (NYSE:BFS), Passage Bio, Inc. (NASDAQ:PASG), Avid Technology, Inc. (NASDAQ:AVID), and Cowen Inc. (NASDAQ:COWN). This group of stocks’ market caps match DFIN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GEO | 13 | 72580 | -5 |

| FANH | 7 | 2532 | -1 |

| LIND | 11 | 105194 | 0 |

| BFS | 8 | 20514 | 2 |

| PASG | 14 | 287643 | 4 |

| AVID | 22 | 319667 | -4 |

| COWN | 27 | 223894 | 2 |

| Average | 14.6 | 147432 | -0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.6 hedge funds with bullish positions and the average amount invested in these stocks was $147 million. That figure was $134 million in DFIN’s case. Cowen Inc. (NASDAQ:COWN) is the most popular stock in this table. On the other hand Fanhua Inc. (NASDAQ:FANH) is the least popular one with only 7 bullish hedge fund positions. Donnelley Financial Solutions, Inc. (NYSE:DFIN) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for DFIN is 49.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.5% in 2021 through July 23rd and still beat the market by 10.1 percentage points. Hedge funds were also right about betting on DFIN, though not to the same extent, as the stock returned 12.9% since Q1 (through July 23rd) and outperformed the market as well.

Follow Donnelley Financial Solutions Inc. (NYSE:DFIN)

Follow Donnelley Financial Solutions Inc. (NYSE:DFIN)

Receive real-time insider trading and news alerts

Suggested Articles:

- George Soros’ Top 10 Stock Picks

- 10 Best Software Stocks To Buy Now

- 10 Most Profitable Movies Of All Time

Disclosure: None. This article was originally published at Insider Monkey.