Is Voya Financial Inc (NYSE:VOYA) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

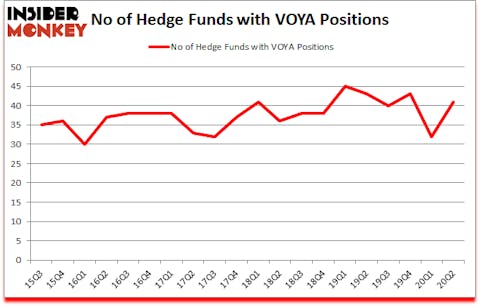

Voya Financial Inc (NYSE:VOYA) was in 41 hedge funds’ portfolios at the end of June. The all time high for this statistics is 45. VOYA shareholders have witnessed an increase in support from the world’s most elite money managers of late. There were 32 hedge funds in our database with VOYA holdings at the end of March. Our calculations also showed that VOYA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 56 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Ryan Tolkin, CIO of Schonfeld Strategic Advisors

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind let’s go over the latest hedge fund action surrounding Voya Financial Inc (NYSE:VOYA).

Hedge fund activity in Voya Financial Inc (NYSE:VOYA)

At Q2’s end, a total of 41 of the hedge funds tracked by Insider Monkey were long this stock, a change of 28% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards VOYA over the last 20 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Pzena Investment Management was the largest shareholder of Voya Financial Inc (NYSE:VOYA), with a stake worth $237.9 million reported as of the end of September. Trailing Pzena Investment Management was Samlyn Capital, which amassed a stake valued at $236 million. Citadel Investment Group, Millennium Management, and Point72 Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Strycker View Capital allocated the biggest weight to Voya Financial Inc (NYSE:VOYA), around 8.44% of its 13F portfolio. Capital Returns Management is also relatively very bullish on the stock, designating 4.4 percent of its 13F equity portfolio to VOYA.

Now, key hedge funds were leading the bulls’ herd. Alyeska Investment Group, managed by Anand Parekh, created the most valuable position in Voya Financial Inc (NYSE:VOYA). Alyeska Investment Group had $18.1 million invested in the company at the end of the quarter. Clint Carlson’s Carlson Capital also made a $12.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Usman Waheed’s Strycker View Capital, Richard SchimeláandáLawrence Sapanski’s Cinctive Capital Management, and Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors.

Let’s check out hedge fund activity in other stocks similar to Voya Financial Inc (NYSE:VOYA). These stocks are Thor Industries, Inc. (NYSE:THO), Berry Global Group Inc (NYSE:BERY), Axon Enterprise, Inc. (NASDAQ:AAXN), Farfetch Limited (NYSE:FTCH), Donaldson Company, Inc. (NYSE:DCI), Sensata Technologies Holding plc (NYSE:ST), and Santander Consumer USA Holdings Inc (NYSE:SC). This group of stocks’ market values are closest to VOYA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| THO | 39 | 301565 | 19 |

| BERY | 40 | 1455029 | 6 |

| AAXN | 39 | 609333 | 13 |

| FTCH | 37 | 837456 | 15 |

| DCI | 27 | 226099 | 7 |

| ST | 33 | 1073165 | 7 |

| SC | 20 | 561451 | 0 |

| Average | 33.6 | 723443 | 9.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.6 hedge funds with bullish positions and the average amount invested in these stocks was $723 million. That figure was $792 million in VOYA’s case. Berry Global Group Inc (NYSE:BERY) is the most popular stock in this table. On the other hand Santander Consumer USA Holdings Inc (NYSE:SC) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Voya Financial Inc (NYSE:VOYA) is more popular among hedge funds. Our overall hedge fund sentiment score for VOYA is 87.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 30% in 2020 through October 23rd and still managed to beat the market by 21 percentage points. Hedge funds were also right about betting on VOYA, though not to the same extent, as the stock returned 13% since the end of June (through October 23rd) and outperformed the market as well.

Follow Voya Financial Inc. (NYSE:VOYA)

Follow Voya Financial Inc. (NYSE:VOYA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.