In this article we will take a look at whether hedge funds think Cirrus Logic, Inc. (NASDAQ:CRUS) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

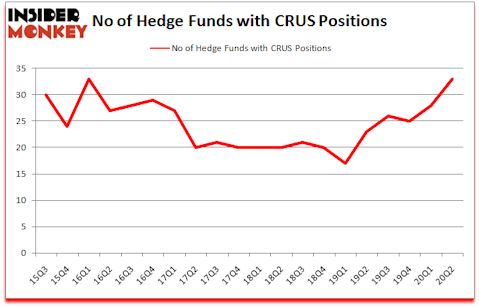

Is Cirrus Logic, Inc. (NASDAQ:CRUS) undervalued? Hedge funds were in a bullish mood. The number of bullish hedge fund bets went up by 5 lately. Cirrus Logic, Inc. (NASDAQ:CRUS) was in 33 hedge funds’ portfolios at the end of June. The all time high for this statistics is 33. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that CRUS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 28 hedge funds in our database with CRUS holdings at the end of March.

Video: Watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are perceived as slow, old financial vehicles of the past. While there are greater than 8000 funds in operation today, Our experts look at the leaders of this group, around 850 funds. These money managers command the majority of the smart money’s total asset base, and by tracking their matchless equity investments, Insider Monkey has figured out a number of investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 biggest insurance companies to identify fast growing companies in various industries. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Keeping this in mind let’s go over the fresh hedge fund action regarding Cirrus Logic, Inc. (NASDAQ:CRUS).

How are hedge funds trading Cirrus Logic, Inc. (NASDAQ:CRUS)?

Heading into the third quarter of 2020, a total of 33 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in CRUS over the last 20 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Cliff Asness’s AQR Capital Management has the largest position in Cirrus Logic, Inc. (NASDAQ:CRUS), worth close to $60.3 million, amounting to 0.1% of its total 13F portfolio. Sitting at the No. 2 spot is Royce & Associates, managed by Chuck Royce, which holds a $48.2 million position; 0.5% of its 13F portfolio is allocated to the stock. Other professional money managers with similar optimism include Renaissance Technologies, Israel Englander’s Millennium Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. In terms of the portfolio weights assigned to each position Woodline Partners allocated the biggest weight to Cirrus Logic, Inc. (NASDAQ:CRUS), around 0.83% of its 13F portfolio. Royce & Associates is also relatively very bullish on the stock, earmarking 0.53 percent of its 13F equity portfolio to CRUS.

With a general bullishness amongst the heavyweights, key money managers were leading the bulls’ herd. Woodline Partners, managed by Michael Rockefeller and KarláKroeker, assembled the largest position in Cirrus Logic, Inc. (NASDAQ:CRUS). Woodline Partners had $21 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $8.7 million position during the quarter. The following funds were also among the new CRUS investors: Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, and Peter Muller’s PDT Partners.

Let’s check out hedge fund activity in other stocks similar to Cirrus Logic, Inc. (NASDAQ:CRUS). These stocks are Silgan Holdings Inc. (NASDAQ:SLGN), Spirit Realty Capital Inc (NYSE:SRC), United Bankshares, Inc. (NASDAQ:UBSI), Equitrans Midstream Corporation (NYSE:ETRN), Valvoline Inc. (NYSE:VVV), WPX Energy Inc (NYSE:WPX), and Terreno Realty Corporation (NYSE:TRNO). This group of stocks’ market valuations are closest to CRUS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLGN | 19 | 183360 | 3 |

| SRC | 18 | 154998 | 0 |

| UBSI | 16 | 44023 | 3 |

| ETRN | 29 | 465675 | 10 |

| VVV | 40 | 634494 | 1 |

| WPX | 37 | 230770 | 8 |

| TRNO | 9 | 29693 | -1 |

| Average | 24 | 249002 | 3.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $249 million. That figure was $316 million in CRUS’s case. Valvoline Inc. (NYSE:VVV) is the most popular stock in this table. On the other hand Terreno Realty Corporation (NYSE:TRNO) is the least popular one with only 9 bullish hedge fund positions. Cirrus Logic, Inc. (NASDAQ:CRUS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for CRUS is 78.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Hedge funds were also right about betting on CRUS as the stock returned 11.5% since the end of Q2 (through 10/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Cirrus Logic Inc. (NASDAQ:CRUS)

Follow Cirrus Logic Inc. (NASDAQ:CRUS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.