Is Charles River Laboratories International Inc. (NYSE:CRL) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

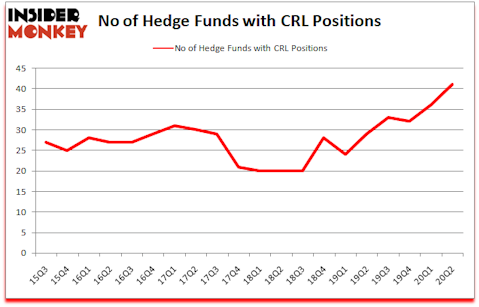

Is Charles River Laboratories International Inc. (NYSE:CRL) the right investment to pursue these days? Prominent investors were taking a bullish view. The number of long hedge fund bets rose by 5 recently. Charles River Laboratories International Inc. (NYSE:CRL) was in 41 hedge funds’ portfolios at the end of June. The all time high for this statistics is 36. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that CRL isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 56 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 34% through August 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind we’re going to review the latest hedge fund action encompassing Charles River Laboratories International Inc. (NYSE:CRL).

What have hedge funds been doing with Charles River Laboratories International Inc. (NYSE:CRL)?

At the end of June, a total of 41 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from one quarter earlier. On the other hand, there were a total of 29 hedge funds with a bullish position in CRL a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Charles River Laboratories International Inc. (NYSE:CRL), which was worth $180.4 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $123.3 million worth of shares. Ariel Investments, Iridian Asset Management, and OZ Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Tower House Partners allocated the biggest weight to Charles River Laboratories International Inc. (NYSE:CRL), around 19.4% of its 13F portfolio. Iron Triangle Partners is also relatively very bullish on the stock, designating 5.71 percent of its 13F equity portfolio to CRL.

As aggregate interest increased, key money managers have jumped into Charles River Laboratories International Inc. (NYSE:CRL) headfirst. Tower House Partners, managed by Paolo Mortarotti, assembled the biggest position in Charles River Laboratories International Inc. (NYSE:CRL). Tower House Partners had $40.1 million invested in the company at the end of the quarter. Anthony Bozza’s Lakewood Capital Management also initiated a $39.2 million position during the quarter. The following funds were also among the new CRL investors: Ricky Sandler’s Eminence Capital, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Anand Parekh’s Alyeska Investment Group.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Charles River Laboratories International Inc. (NYSE:CRL) but similarly valued. These stocks are Natura &Co Holding S.A. (NYSE:NTCO), Brookfield Renewable Partners L.P. (NYSE:BEP), Elanco Animal Health Incorporated (NYSE:ELAN), James Hardie Industries plc (NYSE:JHX), IPG Photonics Corporation (NASDAQ:IPGP), F5 Networks, Inc. (NASDAQ:FFIV), and Shaw Communications Inc (NYSE:SJR). This group of stocks’ market valuations resemble CRL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTCO | 5 | 85507 | -3 |

| BEP | 5 | 30355 | 2 |

| ELAN | 30 | 212753 | 4 |

| JHX | 5 | 11376 | 1 |

| IPGP | 30 | 239086 | 10 |

| FFIV | 39 | 1073838 | 7 |

| SJR | 13 | 129866 | 1 |

| Average | 18.1 | 254683 | 3.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.1 hedge funds with bullish positions and the average amount invested in these stocks was $255 million. That figure was $1051 million in CRL’s case. F5 Networks, Inc. (NASDAQ:FFIV) is the most popular stock in this table. On the other hand Natura &Co Holding S.A. (NYSE:NTCO) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Charles River Laboratories International Inc. (NYSE:CRL) is more popular among hedge funds. Our overall hedge fund sentiment score for CRL is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 30% in 2020 through October 23rd but still managed to beat the market by 21 percentage points. Hedge funds were also right about betting on CRL as the stock returned 33.5% since the end of June (through 10/23) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Charles River Laboratories International Inc. (NYSE:CRL)

Follow Charles River Laboratories International Inc. (NYSE:CRL)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.