Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about General Mills, Inc. (NYSE:GIS) in this article.

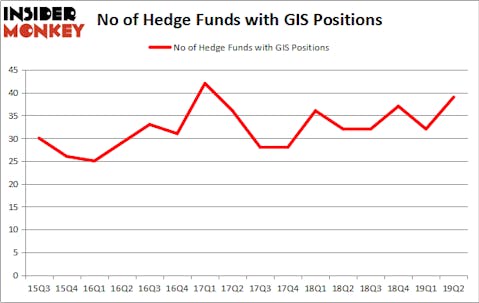

General Mills, Inc. (NYSE:GIS) was in 39 hedge funds’ portfolios at the end of June. GIS has seen an increase in enthusiasm from smart money in recent months. There were 32 hedge funds in our database with GIS holdings at the end of the previous quarter. Our calculations also showed that GIS isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to review the recent hedge fund action encompassing General Mills, Inc. (NYSE:GIS).

How are hedge funds trading General Mills, Inc. (NYSE:GIS)?

At the end of the second quarter, a total of 39 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 22% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GIS over the last 16 quarters. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, holds the biggest position in General Mills, Inc. (NYSE:GIS). Renaissance Technologies has a $279.1 million position in the stock, comprising 0.2% of its 13F portfolio. The second largest stake is held by Citadel Investment Group, led by Ken Griffin, holding a $278.2 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions include David Cohen and Harold Levy’s Iridian Asset Management, and Israel Englander’s Millennium Management.

As aggregate interest increased, key hedge funds have been driving this bullishness. Iridian Asset Management, managed by David Cohen and Harold Levy, assembled the most outsized position in General Mills, Inc. (NYSE:GIS). Iridian Asset Management had $106.9 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $19.9 million position during the quarter. The other funds with new positions in the stock are D. E. Shaw’s D E Shaw, Steve Cohen’s Point72 Asset Management, and Israel Englander’s Millennium Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as General Mills, Inc. (NYSE:GIS) but similarly valued. These stocks are IQVIA Holdings, Inc. (NYSE:IQV), HP Inc. (NYSE:HPQ), Canadian Natural Resources Limited (NYSE:CNQ), and Newmont Goldcorp Corporation (NYSE:NEM). This group of stocks’ market values match GIS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IQV | 67 | 5892581 | 3 |

| HPQ | 32 | 870489 | -3 |

| CNQ | 24 | 424540 | -5 |

| NEM | 41 | 777802 | 6 |

| Average | 41 | 1991353 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41 hedge funds with bullish positions and the average amount invested in these stocks was $1991 million. That figure was $1026 million in GIS’s case. IQVIA Holdings, Inc. (NYSE:IQV) is the most popular stock in this table. On the other hand Canadian Natural Resources Limited (NYSE:CNQ) is the least popular one with only 24 bullish hedge fund positions. General Mills, Inc. (NYSE:GIS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on GIS as the stock returned 5.9% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.