We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s take a look at whether Barrick Gold Corporation (NYSE:GOLD) is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

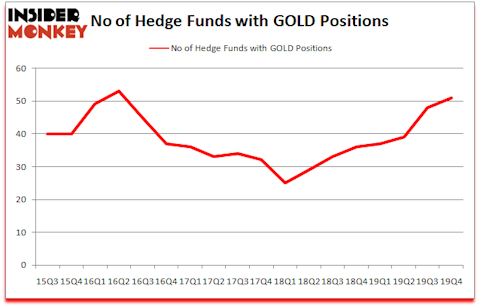

Barrick Gold Corporation (NYSE:GOLD) has seen an increase in hedge fund sentiment in recent months. Our calculations also showed that GOLD isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Richard Driehaus of Driehaus Capital

With all of this in mind let’s go over the key hedge fund action encompassing Barrick Gold Corporation (NYSE:GOLD).

Hedge fund activity in Barrick Gold Corporation (NYSE:GOLD)

At Q4’s end, a total of 51 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards GOLD over the last 18 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies has the biggest position in Barrick Gold Corporation (NYSE:GOLD), worth close to $290.9 million, comprising 0.2% of its total 13F portfolio. The second largest stake is held by Ken Griffin of Citadel Investment Group, with a $188.2 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism encompass David Greenspan’s Slate Path Capital, Phill Gross and Robert Atchinson’s Adage Capital Management and Richard Oldfield’s Oldfield Partners. In terms of the portfolio weights assigned to each position Oldfield Partners allocated the biggest weight to Barrick Gold Corporation (NYSE:GOLD), around 10.13% of its 13F portfolio. Slate Path Capital is also relatively very bullish on the stock, dishing out 9.81 percent of its 13F equity portfolio to GOLD.

Consequently, specific money managers were leading the bulls’ herd. Driehaus Capital, managed by Richard Driehaus, created the biggest position in Barrick Gold Corporation (NYSE:GOLD). Driehaus Capital had $33.7 million invested in the company at the end of the quarter. Ryan Caldwell’s Chiron Investment Management also initiated a $22.2 million position during the quarter. The following funds were also among the new GOLD investors: Michael Gelband’s ExodusPoint Capital, Matthew Tewksbury’s Stevens Capital Management, and Robert Vincent McHugh’s Jade Capital Advisors.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Barrick Gold Corporation (NYSE:GOLD) but similarly valued. We will take a look at Southern Copper Corporation (NYSE:SCCO), General Mills, Inc. (NYSE:GIS), Amphenol Corporation (NYSE:APH), and TE Connectivity Ltd. (NYSE:TEL). This group of stocks’ market values match GOLD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SCCO | 20 | 230399 | 4 |

| GIS | 37 | 907163 | 0 |

| APH | 36 | 715909 | 3 |

| TEL | 44 | 1839961 | 10 |

| Average | 34.25 | 923358 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.25 hedge funds with bullish positions and the average amount invested in these stocks was $923 million. That figure was $1815 million in GOLD’s case. TE Connectivity Ltd. (NYSE:TEL) is the most popular stock in this table. On the other hand Southern Copper Corporation (NYSE:SCCO) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Barrick Gold Corporation (NYSE:GOLD) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 1.3% in 2020 through May 1st but still managed to beat the market by 12.9 percentage points. Hedge funds were also right about betting on GOLD as the stock returned 45.3% so far in 2020 (through May 1st) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.