Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts usually don’t make them change their opinion towards a company. This time it may be different. The coronavirus pandemic destroyed the high correlations among major industries and asset classes. We are now in a stock pickers market where fundamentals of a stock have more effect on the price than the overall direction of the market. As a result we observe sudden and large changes in hedge fund positions depending on the news flow. Let’s take a look at the hedge fund sentiment towards Autodesk, Inc. (NASDAQ:ADSK) to find out whether there were any major changes in hedge funds’ views.

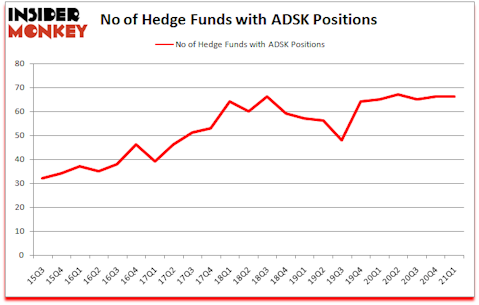

Hedge fund interest in Autodesk, Inc. (NASDAQ:ADSK) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that ADSK isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as NIO Inc. (NYSE:NIO), Equinix, Inc. (REIT) (NASDAQ:EQIX), and Workday Inc (NASDAQ:WDAY) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 115 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

William Von Mueffling of Cantillon Capital Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s take a look at the new hedge fund action regarding Autodesk, Inc. (NASDAQ:ADSK).

Do Hedge Funds Think ADSK Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 66 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. By comparison, 65 hedge funds held shares or bullish call options in ADSK a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, William von Mueffling’s Cantillon Capital Management has the number one position in Autodesk, Inc. (NASDAQ:ADSK), worth close to $341.8 million, accounting for 2.5% of its total 13F portfolio. The second most bullish fund manager is Melvin Capital Management, managed by Gabriel Plotkin, which holds a $291 million position; the fund has 1.7% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish include Ian Simm’s Impax Asset Management, Panayotis Takis Sparaggis’s Alkeon Capital Management and Ken Fisher’s Fisher Asset Management. In terms of the portfolio weights assigned to each position Marlowe Partners allocated the biggest weight to Autodesk, Inc. (NASDAQ:ADSK), around 15.67% of its 13F portfolio. Blue Whale Capital is also relatively very bullish on the stock, designating 6.7 percent of its 13F equity portfolio to ADSK.

Because Autodesk, Inc. (NASDAQ:ADSK) has faced bearish sentiment from hedge fund managers, it’s safe to say that there were a few money managers that decided to sell off their entire stakes by the end of the first quarter. Intriguingly, Lone Pine Capital cut the largest investment of the 750 funds followed by Insider Monkey, totaling close to $675.6 million in stock, and Mick Hellman’s HMI Capital was right behind this move, as the fund dropped about $124.4 million worth. These transactions are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Autodesk, Inc. (NASDAQ:ADSK). These stocks are NIO Inc. (NYSE:NIO), Equinix, Inc. (REIT) (NASDAQ:EQIX), Workday Inc (NASDAQ:WDAY), Global Payments Inc (NYSE:GPN), Banco Santander, S.A. (NYSE:SAN), Capital One Financial Corp. (NYSE:COF), and Twilio Inc. (NYSE:TWLO). This group of stocks’ market valuations match ADSK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NIO | 28 | 1321170 | -6 |

| EQIX | 41 | 1546339 | -1 |

| WDAY | 69 | 5179677 | -11 |

| GPN | 62 | 4558094 | 7 |

| SAN | 15 | 490548 | 1 |

| COF | 59 | 3139814 | 3 |

| TWLO | 99 | 5812460 | 5 |

| Average | 53.3 | 3149729 | -0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 53.3 hedge funds with bullish positions and the average amount invested in these stocks was $3150 million. That figure was $3057 million in ADSK’s case. Twilio Inc. (NYSE:TWLO) is the most popular stock in this table. On the other hand Banco Santander, S.A. (NYSE:SAN) is the least popular one with only 15 bullish hedge fund positions. Autodesk, Inc. (NASDAQ:ADSK) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for ADSK is 64.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 25.8% in 2021 through August 6th and still beat the market by 6.7 percentage points. Hedge funds were also right about betting on ADSK, though not to the same extent, as the stock returned 20.1% since Q1 (through August 6th) and outperformed the market as well.

Follow Autodesk Inc. (NASDAQ:ADSK)

Follow Autodesk Inc. (NASDAQ:ADSK)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Biotech Penny Stocks To Buy

- 25 Top Paying Jobs in America

- 15 Biggest Food Companies In The World

Disclosure: None. This article was originally published at Insider Monkey.