Student loans are a hotly debated and contested product across the financial services industry, a key gripe of the Occupy Wall Street protestors, and the subject of much debate in Washington.

In the midst a changing industry, one bank has made a concerted effort to grow through acquisitions — and perhaps become a market leader.

The industry

College costs at public four-year universities have risen 5.2% per year on average over the last decade, compared to just 3.2% in the prior decade, based on a report done by the College Board. Notably, those costs have risen even faster than inflation:

Source: Student Loan Data — College Board, Inflation Data: Bureau of Labor Statistics.

It should therefore come as no surprise that the student loan market ballooned in recent years, as more and more college students headed to the banks to finance their degrees. In fact, according to the most recent National Postsecondary Student Aid study from the National Center for Education Statistics, 71% of students received financial aid of some sort, and 42% of students undertook student loans.

After a stalemate in Washington D.C., the interest rates for newly issued federally guaranteed student loans doubled to 6.8% on July 1. It took presidential action earlier this month to restore them to 3.9%, as Barack Obama signed a bill linking the interest on the loans to the 10-year U.S. Treasury note. Some 18 million loans were covered by the most recent bill, and with a total outstanding value of $106 billion. That means the average undergraduate will save $1,500 on interest charges compared to the 6.8% rate.

Yet passing that bill will not end the discussion on student loans and the rising costs of education. Last week, President Obama spoke at SUNY Buffalo and stated:

“At a time when a higher education has never been more important or more expensive, too many students are facing a choice that they should never have to make. Either they say no to college, and pay the price for not getting a degree … or you do what it takes to go to college, but then you run the risk that you won’t be able to pay it off because you’ve got so much debt.”

With that, he proposed a plan to rate colleges based on their financial value, then correspondingly distribute federal aid based on their rankings. In this, he hopes to “look out for the students who these institutions exist to serve,” and ease the debt burden while also bringing down the cost of education.

The banks

Clearly, the higher education system could be facing a major overhaul within the coming years. With that in mind, let’s look at five of the biggest publicly traded lenders that participate in the student loan industry.

| Student Loan Balances ($B) | |

|---|---|

| SLM Corp (NASDAQ:SLM) | 145.6 |

| Wells Fargo & Co (NYSE:WFC) | 22.5 |

| JPMorgan Chase & Co. (NYSE:JPM) | 11.0 |

| Discover Financial Services (NYSE:DFS) | 7.9 |

| Bank of America Corp (NYSE:BAC) | 4.4 |

Source: Company Earnings Releases.

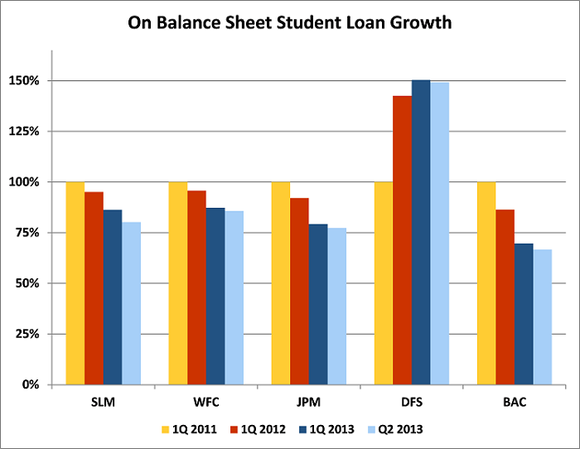

Yet those numbers alone do not give the clearest picture of how dramatically things have changed over the last three years:

Growth relative to 1Q 2011. Source: Company Earnings Reports.

While student loans are often seen as a highly lucrative endeavor for banks, almost all of the major lenders have seen their portfolios decline dramatically since the passage of the Student Aid and Fiscal Responsibility Act in 2010, which no longer guaranteed private student loans.

Wells Fargo & Co (NYSE:WFC) now even categorizes its government-guaranteed student loans in its “Non-Strategic and Liquidating Loan Portfolios,” which has fallen 32%. However, Wells Fargo & Co (NYSE:WFC) has simultaneously seen its non-guaranteed private student loans grow by 25% over that time.