Hedge funds don’t get the respect they used to get. Nowadays investors prefer passive funds over actively managed funds. One thing they don’t realize is that 100% of the passive funds didn’t see the coronavirus recession coming, but a lot of hedge funds did. Even we published an article near the end of February and predicted a US recession. Think about all the losses you could have avoided if you sold your shares in February and bought them back at the end of March.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding The Hartford Financial Services Group, Inc. (NYSE:HIG).

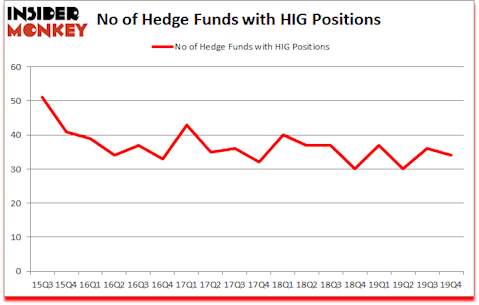

Is The Hartford Financial Services Group, Inc. (NYSE:HIG) a healthy stock for your portfolio? Investors who are in the know are getting less optimistic. The number of long hedge fund positions shrunk by 2 lately. Our calculations also showed that HIG isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

We leave no stone unturned when looking for the next great investment idea. For example, this investor can predict short term winners following earnings announcements with 77% accuracy, so we check out his stock picks. A former hedge fund manager is pitching the “next Amazon” in this video; again we are listening. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a peek at the fresh hedge fund action surrounding The Hartford Financial Services Group, Inc. (NYSE:HIG).

Hedge fund activity in The Hartford Financial Services Group, Inc. (NYSE:HIG)

At the end of the fourth quarter, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -6% from the third quarter of 2019. On the other hand, there were a total of 30 hedge funds with a bullish position in HIG a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ric Dillon’s Diamond Hill Capital has the most valuable position in The Hartford Financial Services Group, Inc. (NYSE:HIG), worth close to $261.8 million, accounting for 1.3% of its total 13F portfolio. The second most bullish fund manager is Citadel Investment Group, managed by Ken Griffin, which holds a $100.3 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism comprise D. E. Shaw’s D E Shaw, Cliff Asness’s AQR Capital Management and Robert Pohly’s Samlyn Capital. In terms of the portfolio weights assigned to each position Diamond Hill Capital allocated the biggest weight to The Hartford Financial Services Group, Inc. (NYSE:HIG), around 1.31% of its 13F portfolio. Prana Capital Management is also relatively very bullish on the stock, setting aside 0.87 percent of its 13F equity portfolio to HIG.

Because The Hartford Financial Services Group, Inc. (NYSE:HIG) has experienced falling interest from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of hedge funds who were dropping their entire stakes heading into Q4. Intriguingly, Clint Carlson’s Carlson Capital dumped the largest position of the 750 funds watched by Insider Monkey, totaling about $52.8 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also said goodbye to its stock, about $33.3 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 2 funds heading into Q4.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as The Hartford Financial Services Group, Inc. (NYSE:HIG) but similarly valued. We will take a look at MSCI Inc (NYSE:MSCI), Fifth Third Bancorp (NASDAQ:FITB), Ventas, Inc. (NYSE:VTR), and Halliburton Company (NYSE:HAL). All of these stocks’ market caps are closest to HIG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MSCI | 42 | 729773 | 2 |

| FITB | 41 | 845596 | 1 |

| VTR | 29 | 655629 | 13 |

| HAL | 31 | 1208089 | -4 |

| Average | 35.75 | 859772 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.75 hedge funds with bullish positions and the average amount invested in these stocks was $860 million. That figure was $739 million in HIG’s case. MSCI Inc (NYSE:MSCI) is the most popular stock in this table. On the other hand Ventas, Inc. (NYSE:VTR) is the least popular one with only 29 bullish hedge fund positions. The Hartford Financial Services Group, Inc. (NYSE:HIG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but beat the market by 12.9 percentage points. Unfortunately HIG wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); HIG investors were disappointed as the stock returned -40.9% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.