Hedge funds don’t get the respect they used to get. Nowadays investors prefer passive funds over actively managed funds. One thing they don’t realize is that 100% of the passive funds didn’t see the coronavirus recession coming, but a lot of hedge funds did. Even we published an article near the end of February and predicted a US recession. Think about all the losses you could have avoided if you sold your shares in February and bought them back at the end of March.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Rambus Inc. (NASDAQ:RMBS).

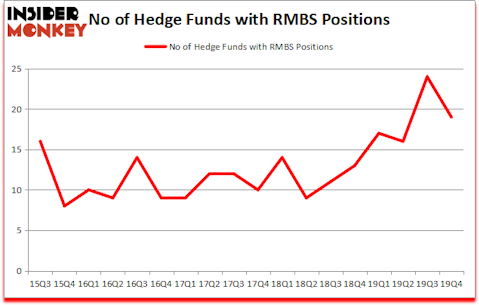

Rambus Inc. (NASDAQ:RMBS) was in 19 hedge funds’ portfolios at the end of the fourth quarter of 2019. RMBS has experienced a decrease in hedge fund interest of late. There were 24 hedge funds in our database with RMBS holdings at the end of the previous quarter. Our calculations also showed that RMBS isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Bruce Kovner of Caxton Associates LP

We leave no stone unturned when looking for the next great investment idea. For example, this investor can predict short term winners following earnings announcements with 77% accuracy, so we check out his stock picks. A former hedge fund manager is pitching the “next Amazon” in this video; again we are listening. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s take a look at the key hedge fund action surrounding Rambus Inc. (NASDAQ:RMBS).

Hedge fund activity in Rambus Inc. (NASDAQ:RMBS)

Heading into the first quarter of 2020, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -21% from the third quarter of 2019. The graph below displays the number of hedge funds with bullish position in RMBS over the last 18 quarters. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

The largest stake in Rambus Inc. (NASDAQ:RMBS) was held by Renaissance Technologies, which reported holding $61.8 million worth of stock at the end of September. It was followed by Lynrock Lake with a $48.2 million position. Other investors bullish on the company included D E Shaw, Arrowstreet Capital, and Two Sigma Advisors. In terms of the portfolio weights assigned to each position Lynrock Lake allocated the biggest weight to Rambus Inc. (NASDAQ:RMBS), around 4.92% of its 13F portfolio. Quantinno Capital is also relatively very bullish on the stock, designating 0.26 percent of its 13F equity portfolio to RMBS.

Since Rambus Inc. (NASDAQ:RMBS) has experienced falling interest from the entirety of the hedge funds we track, it’s safe to say that there exists a select few money managers that decided to sell off their entire stakes in the third quarter. Intriguingly, George Soros’s Soros Fund Management said goodbye to the largest stake of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $14.4 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund said goodbye to about $7.1 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 5 funds in the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Rambus Inc. (NASDAQ:RMBS) but similarly valued. These stocks are Sykes Enterprises, Incorporated (NASDAQ:SYKE), Osisko Gold Royalties Ltd (NYSE:OR), Archrock, Inc. (NYSE:AROC), and Shutterstock Inc (NYSE:SSTK). This group of stocks’ market values are similar to RMBS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SYKE | 18 | 98479 | 4 |

| OR | 13 | 66565 | -1 |

| AROC | 15 | 34297 | 2 |

| SSTK | 15 | 112629 | -1 |

| Average | 15.25 | 77993 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $78 million. That figure was $174 million in RMBS’s case. Sykes Enterprises, Incorporated (NASDAQ:SYKE) is the most popular stock in this table. On the other hand Osisko Gold Royalties Ltd (NYSE:OR) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Rambus Inc. (NASDAQ:RMBS) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.3% in 2020 through May 1st but still managed to beat the market by 12.9 percentage points. Hedge funds were also right about betting on RMBS, though not to the same extent, as the stock returned -10.3% in 2020 (through May 1st) and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.