In this article we are going to use hedge fund sentiment as a tool and determine whether Lear Corporation (NYSE:LEA) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

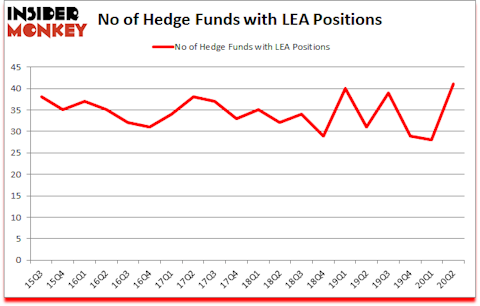

Is Lear Corporation (NYSE:LEA) an exceptional investment right now? Investors who are in the know were getting more optimistic. The number of long hedge fund positions inched up by 13 lately. Lear Corporation (NYSE:LEA) was in 41 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 40. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that LEA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 28 hedge funds in our database with LEA holdings at the end of March.

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are many indicators stock traders use to assess publicly traded companies. Some of the most useful indicators are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the elite fund managers can outclass their index-focused peers by a very impressive margin (see the details here).

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Now let’s take a look at the new hedge fund action regarding Lear Corporation (NYSE:LEA).

How have hedgies been trading Lear Corporation (NYSE:LEA)?

At the end of June, a total of 41 of the hedge funds tracked by Insider Monkey were long this stock, a change of 46% from the previous quarter. The graph below displays the number of hedge funds with bullish position in LEA over the last 20 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Pzena Investment Management was the largest shareholder of Lear Corporation (NYSE:LEA), with a stake worth $541 million reported as of the end of September. Trailing Pzena Investment Management was Paradice Investment Management, which amassed a stake valued at $67.7 million. Balyasny Asset Management, Candlestick Capital Management, and Adage Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Paradice Investment Management allocated the biggest weight to Lear Corporation (NYSE:LEA), around 5.09% of its 13F portfolio. Pzena Investment Management is also relatively very bullish on the stock, setting aside 3.53 percent of its 13F equity portfolio to LEA.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Candlestick Capital Management, managed by Jack Woodruff, initiated the most valuable position in Lear Corporation (NYSE:LEA). Candlestick Capital Management had $34.2 million invested in the company at the end of the quarter. Phill Gross and Robert Atchinson’s Adage Capital Management also initiated a $34.1 million position during the quarter. The other funds with new positions in the stock are Edgar Wachenheim’s Greenhaven Associates, Robert Pohly’s Samlyn Capital, and Alexander Mitchell’s Scopus Asset Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Lear Corporation (NYSE:LEA) but similarly valued. These stocks are Bausch Health Companies Inc. (NYSE:BHC), Kingsoft Cloud Holdings Limited (NASDAQ:KC), Repligen Corporation (NASDAQ:RGEN), GrubHub Inc (NYSE:GRUB), Federal Realty Investment Trust (NYSE:FRT), Plains All American Pipeline, L.P. (NYSE:PAA), and Amedisys Inc (NASDAQ:AMED). This group of stocks’ market values match LEA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BHC | 35 | 1745572 | 0 |

| KC | 20 | 62450 | 20 |

| RGEN | 34 | 688852 | 13 |

| GRUB | 52 | 1080219 | 20 |

| FRT | 20 | 76045 | -4 |

| PAA | 9 | 65144 | 1 |

| AMED | 30 | 375114 | 10 |

| Average | 28.6 | 584771 | 8.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.6 hedge funds with bullish positions and the average amount invested in these stocks was $585 million. That figure was $896 million in LEA’s case. GrubHub Inc (NYSE:GRUB) is the most popular stock in this table. On the other hand Plains All American Pipeline, L.P. (NYSE:PAA) is the least popular one with only 9 bullish hedge fund positions. Lear Corporation (NYSE:LEA) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for LEA is 77.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 30% in 2020 through October 23rd and still beat the market by 21 percentage points. Hedge funds were also right about betting on LEA as the stock returned 23.4% since the end of Q2 (through 10/23) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Lear Corp (NYSE:LEA)

Follow Lear Corp (NYSE:LEA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.