Hedge funds don’t get the respect they used to get. Nowadays investors prefer passive funds over actively managed funds. One thing they don’t realize is that 100% of the passive funds didn’t see the coronavirus recession coming, but a lot of hedge funds did. Even we published an article near the end of February and predicted a US recession. Think about all the losses you could have avoided if you sold your shares in February and bought them back at the end of March. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind let’s see whether iHeartMedia, Inc. (NASDAQ:IHRT) represents a good buying opportunity at the moment.

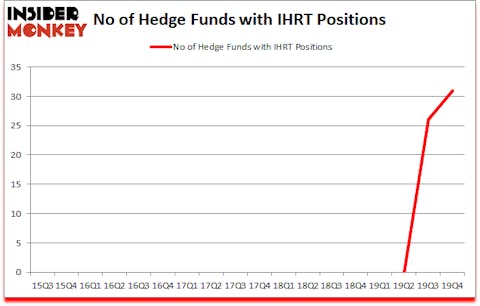

Is iHeartMedia, Inc. (NASDAQ:IHRT) a great investment right now? Hedge funds are getting more optimistic. The number of bullish hedge fund bets rose by 5 lately. Our calculations also showed that IHRT isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Israel Englander of Millennium Management

We leave no stone unturned when looking for the next great investment idea. For example, this investor can predict short term winners following earnings announcements with high accuracy, so we check out his stock picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to take a gander at the key hedge fund action regarding iHeartMedia, Inc. (NASDAQ:IHRT).

What have hedge funds been doing with iHeartMedia, Inc. (NASDAQ:IHRT)?

Heading into the first quarter of 2020, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 19% from the previous quarter. By comparison, 0 hedge funds held shares or bullish call options in IHRT a year ago. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

Among these funds, Brigade Capital held the most valuable stake in iHeartMedia, Inc. (NASDAQ:IHRT), which was worth $46.7 million at the end of the third quarter. On the second spot was Contrarian Capital which amassed $37.7 million worth of shares. OZ Management, Mason Capital Management, and Engle Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Mason Capital Management allocated the biggest weight to iHeartMedia, Inc. (NASDAQ:IHRT), around 7.41% of its 13F portfolio. Lonestar Capital Management is also relatively very bullish on the stock, designating 6.1 percent of its 13F equity portfolio to IHRT.

Consequently, key money managers have jumped into iHeartMedia, Inc. (NASDAQ:IHRT) headfirst. Lonestar Capital Management, managed by Jerome L. Simon, assembled the most outsized position in iHeartMedia, Inc. (NASDAQ:IHRT). Lonestar Capital Management had $10.1 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $2.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Frederick DiSanto’s Ancora Advisors, Donald Sussman’s Paloma Partners, and Scott Kapnick’s HPS Investment Partners.

Let’s go over hedge fund activity in other stocks similar to iHeartMedia, Inc. (NASDAQ:IHRT). These stocks are Weis Markets, Inc. (NYSE:WMK), Abercrombie & Fitch Co. (NYSE:ANF), HudBay Minerals Inc Ord Shs (NYSE:HBM), and Tabula Rasa HealthCare, Inc. (NASDAQ:TRHC). This group of stocks’ market caps match IHRT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WMK | 12 | 50262 | -4 |

| ANF | 26 | 334232 | 3 |

| HBM | 11 | 211228 | -3 |

| TRHC | 6 | 25982 | -5 |

| Average | 13.75 | 155426 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $155 million. That figure was $221 million in IHRT’s case. Abercrombie & Fitch Co. (NYSE:ANF) is the most popular stock in this table. On the other hand Tabula Rasa HealthCare, Inc. (NASDAQ:TRHC) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks iHeartMedia, Inc. (NASDAQ:IHRT) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st and still beat the market by 12.9 percentage points. Unfortunately IHRT wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on IHRT were disappointed as the stock returned -60.1% during the four months of 2020 (through May 1st) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.