The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 873 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 30th. In this article we look at what those investors think of General Electric Company (NYSE:GE).

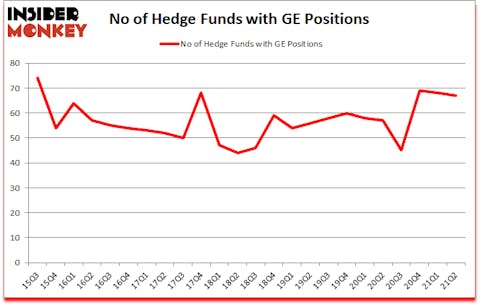

Is General Electric Company (NYSE:GE) a buy here? The best stock pickers were selling. The number of long hedge fund positions shrunk by 1 recently. General Electric Company (NYSE:GE) was in 67 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 74. Our calculations also showed that GE isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

To the average investor there are a multitude of indicators market participants put to use to evaluate their holdings. A pair of the most underrated indicators are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the top investment managers can outclass the market by a very impressive amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Richard S. Pzena of Pzena Investment Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. We check out articles like Warren Buffett’s 3 money saving tips that provide inflation and volatility hedges. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s take a look at the recent hedge fund action regarding General Electric Company (NYSE:GE).

Do Hedge Funds Think GE Is A Good Stock To Buy Now?

At the end of June, a total of 67 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -1% from the first quarter of 2020. On the other hand, there were a total of 57 hedge funds with a bullish position in GE a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in General Electric Company (NYSE:GE) was held by Eagle Capital Management, which reported holding $1512.6 million worth of stock at the end of June. It was followed by Viking Global with a $1235.5 million position. Other investors bullish on the company included Pzena Investment Management, Trian Partners, and Southeastern Asset Management. In terms of the portfolio weights assigned to each position SAYA Management allocated the biggest weight to General Electric Company (NYSE:GE), around 6.78% of its 13F portfolio. Southeastern Asset Management is also relatively very bullish on the stock, designating 5.86 percent of its 13F equity portfolio to GE.

Due to the fact that General Electric Company (NYSE:GE) has witnessed falling interest from hedge fund managers, logic holds that there exists a select few money managers who were dropping their full holdings in the second quarter. Intriguingly, Boykin Curry’s Eagle Capital Management dumped the largest stake of all the hedgies tracked by Insider Monkey, valued at about $1484.2 million in stock. Brandon Haley’s fund, Holocene Advisors, also cut its stock, about $152.7 million worth. These transactions are interesting, as total hedge fund interest dropped by 1 funds in the second quarter.

Let’s check out hedge fund activity in other stocks similar to General Electric Company (NYSE:GE). These stocks are HSBC Holdings plc (NYSE:HSBC), Vale SA (NYSE:VALE), The Estee Lauder Companies Inc (NYSE:EL), 3M Company (NYSE:MMM), Advanced Micro Devices, Inc. (NASDAQ:AMD), Zoom Video Communications, Inc. (NASDAQ:ZM), and Diageo plc (NYSE:DEO). This group of stocks’ market caps match GE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HSBC | 11 | 212763 | -1 |

| VALE | 27 | 3573958 | -4 |

| EL | 50 | 4129744 | -9 |

| MMM | 42 | 1582540 | 1 |

| AMD | 63 | 4610011 | 1 |

| ZM | 59 | 8480712 | 5 |

| DEO | 20 | 891081 | -2 |

| Average | 38.9 | 3354401 | -1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.9 hedge funds with bullish positions and the average amount invested in these stocks was $3354 million. That figure was $6087 million in GE’s case. Advanced Micro Devices, Inc. (NASDAQ:AMD) is the most popular stock in this table. On the other hand HSBC Holdings plc (NYSE:HSBC) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks General Electric Company (NYSE:GE) is more popular among hedge funds. Our overall hedge fund sentiment score for GE is 81.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 26.3% in 2021 through October 29th and still beat the market by 2.3 percentage points. Unfortunately GE wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on GE were disappointed as the stock returned -2.5% since the end of the second quarter (through 10/29) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow General Electric Co (NYSE:GE)

Follow General Electric Co (NYSE:GE)

Receive real-time insider trading and news alerts

Suggested Articles:

- 11 Best Casino and Gambling Stocks To Buy Now

- 10 Best Spring Stocks to Buy Now

- 10 Best Streaming Stocks to Buy Now

Disclosure: None. This article was originally published at Insider Monkey.