We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Fortive Corporation (NYSE:FTV).

Hedge fund interest in Fortive Corporation (NYSE:FTV) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that FTV isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as China Telecom Corporation Limited (NYSE:CHA), Banco Bilbao Vizcaya Argentaria SA (NYSE:BBVA), and Ball Corporation (NYSE:BLL) to gather more data points. Our calculations also showed that FTV isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most traders, hedge funds are seen as underperforming, old financial vehicles of yesteryear. While there are over 8000 funds in operation today, Our researchers hone in on the leaders of this club, approximately 850 funds. These investment experts watch over the lion’s share of the hedge fund industry’s total capital, and by shadowing their inimitable equity investments, Insider Monkey has found a few investment strategies that have historically surpassed the market. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Andreas Halvorsen of Viking Global

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 biggest insurance companies to identify fast growing companies in various industries. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Keeping this in mind we’re going to take a look at the key hedge fund action surrounding Fortive Corporation (NYSE:FTV).

What have hedge funds been doing with Fortive Corporation (NYSE:FTV)?

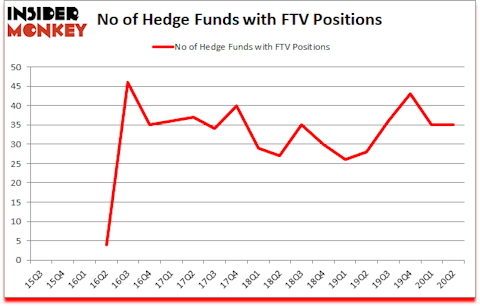

At the end of June, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in FTV over the last 20 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Viking Global, managed by Andreas Halvorsen, holds the number one position in Fortive Corporation (NYSE:FTV). Viking Global has a $592.7 million position in the stock, comprising 2.6% of its 13F portfolio. On Viking Global’s heels is Phill Gross and Robert Atchinson of Adage Capital Management, with a $205.2 million position; 0.5% of its 13F portfolio is allocated to the company. Remaining members of the smart money with similar optimism contain Ken Griffin’s Citadel Investment Group, Robert Joseph Caruso’s Select Equity Group and Anand Parekh’s Alyeska Investment Group. In terms of the portfolio weights assigned to each position Appian Way Asset Management allocated the biggest weight to Fortive Corporation (NYSE:FTV), around 5.87% of its 13F portfolio. Jade Capital Advisors is also relatively very bullish on the stock, dishing out 3.32 percent of its 13F equity portfolio to FTV.

Seeing as Fortive Corporation (NYSE:FTV) has faced bearish sentiment from the smart money, logic holds that there exists a select few hedge funds that decided to sell off their positions entirely in the second quarter. At the top of the heap, Daniel S. Och’s OZ Management dropped the largest position of the 750 funds monitored by Insider Monkey, valued at about $20.2 million in stock. D. E. Shaw’s fund, D E Shaw, also sold off its stock, about $18.3 million worth. These transactions are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Fortive Corporation (NYSE:FTV) but similarly valued. These stocks are China Telecom Corporation Limited (NYSE:CHA), Banco Bilbao Vizcaya Argentaria SA (NYSE:BBVA), Ball Corporation (NYSE:BLL), Kellogg Company (NYSE:K), Incyte Corporation (NASDAQ:INCY), Tencent Music Entertainment Group (NYSE:TME), and Liberty Broadband Corp (NASDAQ:LBRDA). This group of stocks’ market values are similar to FTV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHA | 5 | 30145 | 0 |

| BBVA | 11 | 164405 | 3 |

| BLL | 38 | 767527 | -3 |

| K | 33 | 418366 | -4 |

| INCY | 29 | 4432332 | -11 |

| TME | 30 | 538341 | 5 |

| LBRDA | 22 | 718343 | -4 |

| Average | 24 | 1009923 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $1010 million. That figure was $1372 million in FTV’s case. Ball Corporation (NYSE:BLL) is the most popular stock in this table. On the other hand China Telecom Corporation Limited (NYSE:CHA) is the least popular one with only 5 bullish hedge fund positions. Fortive Corporation (NYSE:FTV) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for FTV is 73.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Hedge funds were also right about betting on FTV, though not to the same extent, as the stock returned 8.9% since Q2 (through October 30th) and outperformed the market as well.

Follow Fortive Corp (NYSE:FTV)

Follow Fortive Corp (NYSE:FTV)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.