The Insider Monkey team has completed processing the quarterly 13F filings for the June quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Edwards Lifesciences Corporation (NYSE:EW).

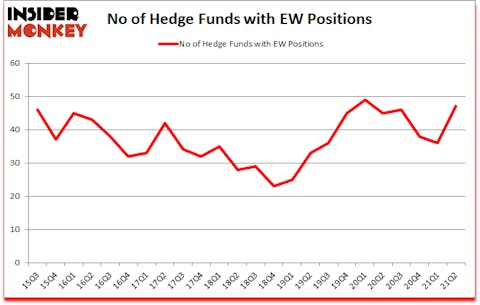

Edwards Lifesciences Corporation (NYSE:EW) investors should be aware of an increase in activity from the world’s largest hedge funds recently. Edwards Lifesciences Corporation (NYSE:EW) was in 47 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 49. Our calculations also showed that EW isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, billionaire John Paulson is loading up on the miners, so we are checking out stock pitches like this mining stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s take a peek at the key hedge fund action encompassing Edwards Lifesciences Corporation (NYSE:EW).

Do Hedge Funds Think EW Is A Good Stock To Buy Now?

At second quarter’s end, a total of 47 of the hedge funds tracked by Insider Monkey were long this stock, a change of 31% from the previous quarter. The graph below displays the number of hedge funds with bullish position in EW over the last 24 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in Edwards Lifesciences Corporation (NYSE:EW) was held by Fisher Asset Management, which reported holding $637.7 million worth of stock at the end of June. It was followed by Arrowstreet Capital with a $153 million position. Other investors bullish on the company included GLG Partners, D1 Capital Partners, and OrbiMed Advisors. In terms of the portfolio weights assigned to each position 11 Capital Partners allocated the biggest weight to Edwards Lifesciences Corporation (NYSE:EW), around 3.2% of its 13F portfolio. Giverny Capital is also relatively very bullish on the stock, earmarking 2.55 percent of its 13F equity portfolio to EW.

Now, key money managers have been driving this bullishness. Holocene Advisors, managed by Brandon Haley, established the most valuable position in Edwards Lifesciences Corporation (NYSE:EW). Holocene Advisors had $77.9 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $66.8 million investment in the stock during the quarter. The following funds were also among the new EW investors: Brandon Haley’s Holocene Advisors, Michael Rockefeller and KarláKroeker’s Woodline Partners, and Bhagwan Jay Rao’s Integral Health Asset Management.

Let’s check out hedge fund activity in other stocks similar to Edwards Lifesciences Corporation (NYSE:EW). These stocks are Atlassian Corporation Plc (NASDAQ:TEAM), Autodesk, Inc. (NASDAQ:ADSK), The Southern Company (NYSE:SO), Air Products & Chemicals, Inc. (NYSE:APD), Analog Devices, Inc. (NASDAQ:ADI), Stellantis N.V. (NYSE:STLA), and Banco Santander (Brasil) SA (NYSE:BSBR). This group of stocks’ market caps are similar to EW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TEAM | 64 | 4170236 | -3 |

| ADSK | 64 | 3201341 | -2 |

| SO | 37 | 606405 | 2 |

| APD | 40 | 456440 | 8 |

| ADI | 62 | 5796275 | 12 |

| STLA | 28 | 844328 | 7 |

| BSBR | 7 | 9630 | 2 |

| Average | 43.1 | 2154951 | 3.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 43.1 hedge funds with bullish positions and the average amount invested in these stocks was $2155 million. That figure was $2043 million in EW’s case. Atlassian Corporation Plc (NASDAQ:TEAM) is the most popular stock in this table. On the other hand Banco Santander (Brasil) SA (NYSE:BSBR) is the least popular one with only 7 bullish hedge fund positions. Edwards Lifesciences Corporation (NYSE:EW) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for EW is 73.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 through November 5th and still beat the market by 3.1 percentage points. Hedge funds were also right about betting on EW as the stock returned 14.6% since the end of Q2 (through 11/5) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Edwards Lifesciences Corp (NYSE:EW)

Follow Edwards Lifesciences Corp (NYSE:EW)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Climate Change Stocks to Buy Now

- Top 10 Health Insurance Stocks to Buy

- 10 Underperforming Stocks Targeted By Short Sellers

Disclosure: None. This article was originally published at Insider Monkey.