CVS Caremark Corporation (NYSE:CVS) reported results at the start of May and its front store business comparables were only up 1.4% with front store traffic ‘down slightly’ although it claimed to have gained market share. CVS claimed its market share compared to other drug retailers was up 1.2% and 0.1% against multi-outlet retailers. The former number suggests CVS has taken market share from Walgreen.

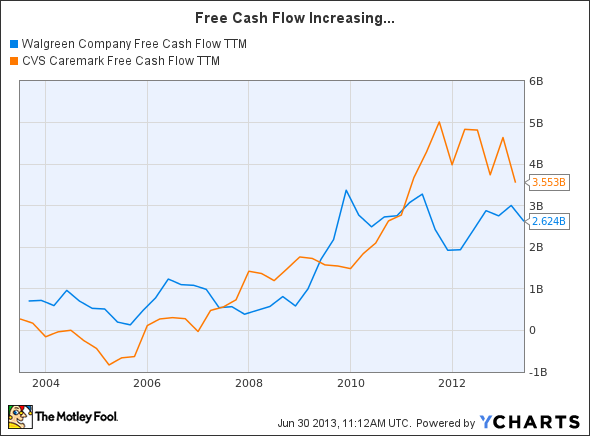

As ever, investors will focus on the CVS vs. Walgreen debate but frankly I see no reason why you can’t hold both! If you like the long term trends of increasing generics sales (which tend to slow revenue growth but increase margins), expanding private label sales (higher margin) and the demand pull from an aging demographic than both are set to grow over the long term. These trends have resulted in substantive increases in free cash flow for these businesses over the last few years.

WAG Free Cash Flow TTM data by YCharts

And despite good stock price performance, both companies look like good values.

WAG Price to Cash Flow TTM data by YCharts

The bottom line

In conclusion, I think there are reasons to be positive. Its retail traffic and sales problems appear to be issues related to pushing its balanced rewards card and losing focus of promotions and discounts. The good news is that recent history suggests that these issues can be rectified in due course within the retail sector. If customers aren’t ‘loyal’ to Walgreen Company (NYSE:WAG) then they are not likely to be loyal to CVS, Wal-Mart, Costco or whoever. Moreover the balanced reward card gives Walgreen more data with which it can better manage its sales initiatives. It can also use reward cards to drive promotions and pricing.

Long-term growth looks assured and history suggests that customers are price sensitive. In other words when Walgreen makes the necessary pricing and promotional adjustments it should see traffic and front store sales growth come back. The valuation remains attractive and I think it’s a decent opportunity to pick some up.

The article Can This Retailer Turn Its Performance Around? originally appeared on Fool.com and is written by Lee Samaha.

Lee Samaha has positions in Walgreen Company (NYSE:WAG) and CVS Caremark. The Motley Fool recommends Costco Wholesale and Procter & Gamble. The Motley Fool owns shares of Costco Wholesale. Lee is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.