Investors in Walgreen Company (NYSE:WAG) have had a pretty good time of it over the last year with a near 50% gain as I write however, the recent results were somewhat disappointing. The market did what it does with an earnings miss and promptly marked the stock down. By now most interested parties will be aware of the situation so I decided to take a more in-depth look at what happened.

In summary, I think that this report contained some of the themes that have been repeatedly seen in the mass consumer market in recent years and this gives cause for optimism.

A tough mass consumer market?

Frankly the last few years have been difficult for the mass consumer market. It has been dogged with the levels of unemployment and sluggish spending that it wasn’t structured to deal with. As a consequence many of the old strategies aren’t working. For example the challenges facing a company like The Procter & Gamble Company (NYSE:PG) have been emblematic. It is known to have classic brands with which it can try and hold pricing (at the expense of volumes) during the downturn and then benefit from profit expansion when the upturn comes and volumes come back.

Unfortunately that upturn hasn’t happened yet –at least in the mass market- and the whole sector has been locked in a circular game of raising marketing and promotional activity, seeing volumes rise, then trying to take pricing, only to then see volumes and footfall decline as customers walk away to competitors. Then the cycle is repeated again with the company hoping that ‘next time round’ it’ll get lucky.

It turns out that the way to play this type of market has been to buy companies with good brands who are under-performing but about to make these changes. Procter & Gamble has been a good example of this. It has had to fight hard to stabilize its core North American market, but its emerging market performance hasn’t been great recently. No matter, the market has rewarded it for sorting out its pricing strategy.

The Procter & Gamble Company (NYSE:PG)’s 25% stock price rise over the last year is a testimony to what can be achieved when companies start to leverage the underlying strength of their brands. For example it recently stated that two thirds of its business in the U.S. (defined by sales) had held or increased sales in the last quarter. This compares very favorably with a figure of only 15% for the June quarter last year.

And Walgreen another?

All of which leads me into Walgreen Company (NYSE:WAG)’s Q3 report. Earnings missed estimates and the disappointment is centered on comparable same store sales only being up .4% and comparable store traffic down 3.9%. It appears to be a familiar story of Walgreen Company (NYSE:WAG) cutting back on promotions and discounts only to see customers walk away to competitors like CVS Caremark Corporation (NYSE:CVS) or even a big box retailer like Costco Wholesale Corporation (NASDAQ:COST).

With regards to Costco its performance in the last quarter, as discussed here, stands in contrast to much of the sector. Costco’s traffic remained stable, but its frequency was up 4-5%. In other words its customers are making more trips, on average, to the store in the quarter. This is a good indication that it is doing a good job engendering customer loyalty and understanding the purchasing needs of its members. This is easier said than done, especially in a quarter categorized by issues such as unseasonable weather, delayed tax refunds, rising gasoline prices, the sequester and payroll tax increases. Costco Wholesale Corporation (NASDAQ:COST) may have done well thanks to its gasoline sales driving customers as well as its relentless focus on pricing.

Unfortunately Walgreen Company (NYSE:WAG) did not fare so well and frankly this wasn’t the time to cutback on pricing and promotions. With that said Walgreen has recognized the problem and a renewed focus on promotions and pricing was initiated in mid May. Essentially it is trying to drive traffic and same store sales growth. This is likely to impact margins, but Walgreen is quite candid that it is more focused on gross profit than margins. Which means that it is willing to discount and promote (which reduces margins) in order to drive revenue and profit growth.

Elsewhere its script comparables were up 7.1% in a market where physician visits were reported to be down 2.7% in May. Therefore I don’t think it’s fair to conclude that the weak sales are a consequence of ongoing weakness due to the Express Scripts Holding Company (NASDAQ:ESRX) debacle. Walgreen is winning customers back.

CVS Caremark Corporation (NYSE:CVS) reported results at the start of May and its front store business comparables were only up 1.4% with front store traffic ‘down slightly’ although it claimed to have gained market share. CVS claimed its market share compared to other drug retailers was up 1.2% and 0.1% against multi-outlet retailers. The former number suggests CVS has taken market share from Walgreen.

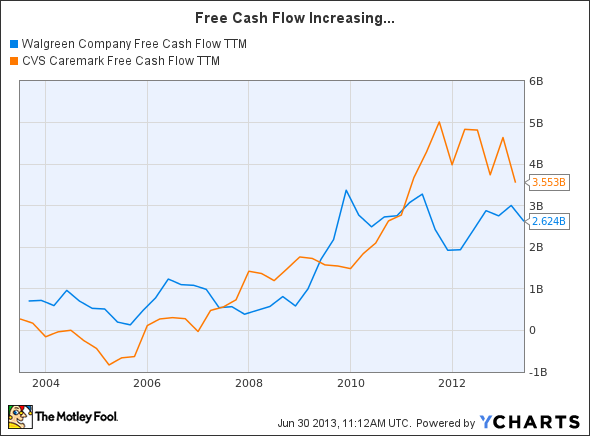

As ever, investors will focus on the CVS vs. Walgreen debate but frankly I see no reason why you can’t hold both! If you like the long term trends of increasing generics sales (which tend to slow revenue growth but increase margins), expanding private label sales (higher margin) and the demand pull from an aging demographic than both are set to grow over the long term. These trends have resulted in substantive increases in free cash flow for these businesses over the last few years.

WAG Free Cash Flow TTM data by YCharts

And despite good stock price performance, both companies look like good values.

WAG Price to Cash Flow TTM data by YCharts

The bottom line

In conclusion, I think there are reasons to be positive. Its retail traffic and sales problems appear to be issues related to pushing its balanced rewards card and losing focus of promotions and discounts. The good news is that recent history suggests that these issues can be rectified in due course within the retail sector. If customers aren’t ‘loyal’ to Walgreen Company (NYSE:WAG) then they are not likely to be loyal to CVS, Wal-Mart, Costco or whoever. Moreover the balanced reward card gives Walgreen more data with which it can better manage its sales initiatives. It can also use reward cards to drive promotions and pricing.

Long-term growth looks assured and history suggests that customers are price sensitive. In other words when Walgreen makes the necessary pricing and promotional adjustments it should see traffic and front store sales growth come back. The valuation remains attractive and I think it’s a decent opportunity to pick some up.

The article Can This Retailer Turn Its Performance Around? originally appeared on Fool.com and is written by Lee Samaha.

Lee Samaha has positions in Walgreen Company (NYSE:WAG) and CVS Caremark. The Motley Fool recommends Costco Wholesale and Procter & Gamble. The Motley Fool owns shares of Costco Wholesale. Lee is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.