On Thursday morning, Wal-Mart Stores, Inc. (NYSE:WMT) reported fourth-quarter EPS of $1.67, ahead of analyst estimates for EPS of $1.57. The earnings beat was especially welcome after reports surfaced last week about poor sales trends in January and early February. The better-than-feared earnings report led to a relief rally on Thursday, with shares gaining 1.5% in a down market.

Not so fast

However, the Wal-Mart earnings report was weaker than it may have appeared at first glance. The company posted 11% EPS growth, but this was largely attributable to one-time tax benefits. If we ignore the change in Wal-Mart’s effective tax rate, earnings growth was anemic; pre-tax income grew by just 3%. In the U.S., which represents more than 70% of Wal-Mart’s sales, the company posted a comparable-store sales increase of 1.3% (including Sam’s Club warehouses). Total company sales grew by 3.9%, helped by new store openings and better sales growth in international markets.

As a result of the weakness at the beginning of the first quarter, Wal-Mart U.S. is projecting flat comparable-store sales this quarter. The Sam’s Club warehouse segment projects comp sales flat to up 2%. Furthermore, Wal-Mart guided first-quarter EPS at $1.11 to $1.16, somewhat better than last year’s first quarter, but below the average analyst estimate of $1.18. The midpoint of Wal-Mart’s full-year EPS guidance of $5.20 to $5.40 was also below expectations.

Better opportunities

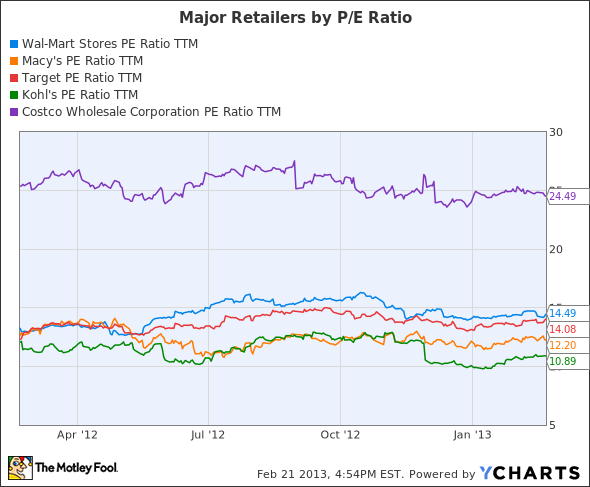

At 14 times trailing earnings, Wal-Mart is not particularly cheap compared to other major retailers. Wal-Mart’s P/E is higher than that of Target Corporation (NYSE:TGT), Macy’s, Inc. (NYSE:M), and Kohl’s Corporation (NYSE:KSS). Costco Wholesale Corporation (NASDAQ:COST) does have a significantly higher valuation, but also offers high-single-digit revenue growth, unlike Wal-Mart.

Retailer P/E Ratio Comparison, data by YCharts.

Costco is a little pricey for my taste, despite its leading position in the warehouse segment. Its low-price advantage has helped it grow despite the sluggish U.S. economy, but that does not make it immune to economic weakness. Sales growth dropped off last month; if the trend continues, Costco could experience painful multiple contraction. Kohl’s has also experienced weak sales and poor execution recently, justifying its industry-trailing earnings multiple.

However, Macy’s and Target both seem to represent better investment opportunities than Wal-Mart right now; they offer better growth prospects at lower earnings multiples. Target’s comparable-store sales underperformed Wal-Mart’s last quarter, at 0.4%, but the company has a much bigger international growth opportunity. Target plans to enter the Canadian market in a big way this year, opening 125 stores beginning next month. Meanwhile, Macy’s generated a 3.9% gain in comparable-store sales last quarter, and 3.7% for the full year, driven by a greater-than-40% increase in online sales.

With Target offering superior international growth prospects, and Macy’s providing a better record of consistent comparable-store sales growth, these companies appear to be better investment candidates than Wal-Mart.

The article Wal-Mart Profit: Weaker Than It Looks originally appeared on Fool.com and is written by Adam Levine-Weinberg.

Fool contributor Adam Levine-Weinberg has no position in any stocks mentioned. The Motley Fool recommends Costco Wholesale. The Motley Fool owns shares of Costco Wholesale.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.