Ted Kang’s Kylin Management was one of the best performing hedge funds during the third quarter based on the returns of its positions disclosed in 13F filings with the Securities and Exchange Commission. Kylin Management’s U.S equity portfolio was worth $754 million as of the end of the first quarter. The New York-based hedge fund was founded in 2005 by Mr. Kang, an ex-employee of Julian Robertson’s Tiger Management, and the firm currently manages $3.25 billion in regulatory assets under management.

In this article we will highlight 4 positions in Chinese stocks that are in Kylin’s portfolio.

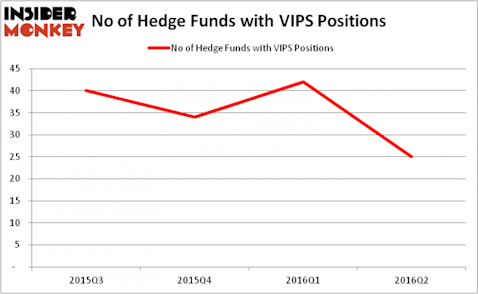

Vipshop Holdings Ltd – ADR (NYSE:VIPS) was the largest position in the portfolio. Kylin Management held the most valuable stake in Vipshop Holdings, which was worth $243.4 at the end of the second quarter. Several hedge funds sold their stakes in Vipshop Holdings during the second quarter and missed out on a total Q3 return of more than 31%. Ted Kang went against the grain and actually boosted his position by 15% right before the 31% jump in the stock. On the second spot was Serenity Capital which amassed $51 worth of shares. Moreover, Ivory Capital, Alkeon Capital Management, and Bloom Tree Partners were also bullish on Vipshop Holdings Ltd – ADR (NYSE:VIPS).

Next we’re going to take a gander at the new hedge fund action regarding Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP).. At the end of the second quarter, a total of 43 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -36% from the previous quarter. In constrast to other hedge fund managers, Ted Kang timed the market correctly and boosted his stake by 17% before CTRP’s 13% gain during the third quarter.

Of the funds tracked by Insider Monkey, Ken Fisher’s Fisher Asset Management has the number one position in Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP), worth close to $410.1 million, accounting for 0.8% of its total 13F portfolio. The second largest stake is held by Hillhouse Capital Management, led by Lei Zhang, holding a $333.4 million position; the fund has 8.4% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism consist of Andreas Halvorsen’s Viking Global, Jason Karp’s Tourbillon Capital Partners and Daniel S. Och’s OZ Management.

Follow Trip.com Group Limited (NASDAQ:TCOM)

Follow Trip.com Group Limited (NASDAQ:TCOM)

Receive real-time insider trading and news alerts

Next is New Oriental Education & Tech Grp (ADR) (NYSE:EDU). Heading into the third quarter of 2016, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock.