We came across a bullish thesis on Viavi Solutions Inc. on Make Money, Make Time’s Substack by Oliver | MMMT Wealth. In this article, we will summarize the bulls’ thesis on VIAV. Viavi Solutions Inc.’s share was trading at $17.88 as of December 15th. VIAV’s trailing and forward P/E were 298.08 and 24.57 respectively according to Yahoo Finance.

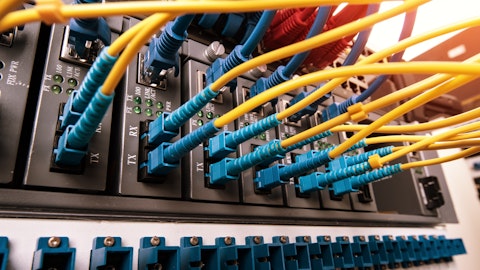

Viavi Solutions Inc. provides network test, monitoring, and assurance solutions for telecommunications, cloud, enterprises, first responders, military, aerospace, and critical infrastructures in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa. VIAV has emerged as a pivotal player in the optics industry, capitalizing on the sector’s recent strong performance while positioning itself for substantial growth over the next five years and beyond.

Unlike manufacturers of transceivers, VIAV focuses on producing the critical testing equipment that ensures these high-speed optics function reliably before reaching the market. While this makes the company less explosive in terms of end-product growth, it solidifies its role as an indispensable part of the optics supply chain.

The company is experiencing robust financial momentum, with revenue projected to grow 28% by FY26 and EBITDA expected to expand even faster at 49%, underscoring operational leverage and efficiency in its testing solutions business. VIAV maintains a net income margin of 9.7%, reflecting solid profitability in a highly technical and specialized segment. From a valuation perspective, the company trades at a forward-looking EV/Sales of 3.2x, EV/EBITDA of 15.3x, and a P/E of 27.0x, suggesting room for upside as investors recognize its strategic positioning.

The combination of strong projected financial growth, essential technology for the broader optics ecosystem, and a favorable risk/reward profile makes VIAV an attractive investment. The company is not only benefiting from the optics sector’s tailwinds but also has an enduring moat through its specialized testing equipment, which is critical for ensuring high-speed optical performance. This positions VIAV to capture long-term value, offering investors a compelling opportunity to participate in both near-term growth and sustained industry expansion.

Previously we covered a bullish thesis on Cisco Systems, Inc. (CSCO) by Kroker Equity Research in May 2025, which highlighted its transformation into a full-stack software and infrastructure platform, driven by recurring software revenue, AI growth, and the $28B Splunk acquisition. The stock has appreciated approximately 22.41% since coverage. The thesis still stands. Oliver | MMMT Wealth shares a similar view but focuses on VIAV’s critical role in optics testing equipment.

Viavi Solutions Inc. is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 28 hedge fund portfolios held VIAV at the end of the third quarter which was 21 in the previous quarter. While we acknowledge the risk and potential of VIAV as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than VIAV and that has 10,000% upside potential, check out our report about this cheapest AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy NOW

Disclosure: None.