The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Veracyte Inc (NASDAQ:VCYT) from the perspective of those successful funds.

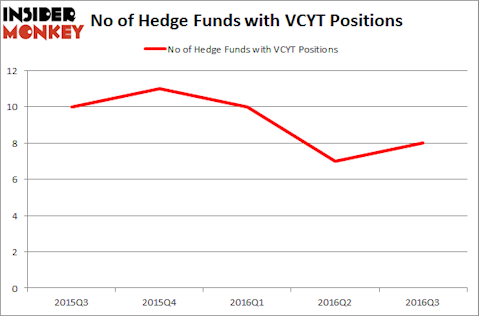

VCYT investors should be aware of an increase in hedge fund sentiment of late. There were 7 hedge funds in our database with VCYT holdings at the end of the previous quarter, versus 8 at the end of Q3. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Flex Pharma Inc (NASDAQ:FLKS), Black Box Corporation (NASDAQ:BBOX), and DRDGOLD Ltd. (ADR) (NYSE:DRD) to gather more data points.

Follow Veracyte Inc. (NASDAQ:VCYT)

Follow Veracyte Inc. (NASDAQ:VCYT)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

g-stockstudio/Shutterstock.com

Now, let’s view the key action encompassing Veracyte Inc (NASDAQ:VCYT).

Hedge fund activity in Veracyte Inc (NASDAQ:VCYT)

At Q3’s end, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from one quarter earlier. On the other hand, there were a total of 11 hedge funds with a bullish position in VCYT at the beginning of this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, venBio Select Advisor holds the most valuable position in Veracyte Inc (NASDAQ:VCYT). venBio Select Advisor has a $7 million position in the stock, comprising 1.2% of its 13F portfolio. On venBio Select Advisor’s heels is Cannell Capital, led by J. Carlo Cannell, holding a $2.9 million position; the fund has 1.2% of its 13F portfolio invested in the stock. Remaining peers that are bullish consist of Ken Greenberg and David Kim’s Ghost Tree Capital, Millennium Management, one of the 10 largest hedge funds in the world, and Jim Simons’ Renaissance Technologies. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Consequently, some big names have jumped into Veracyte Inc (NASDAQ:VCYT) headfirst, including Matthew Strobeck’s Birchview Capital, which made a $0.3 million investment in the stock during the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Veracyte Inc (NASDAQ:VCYT) but similarly valued. We will take a look at Flex Pharma Inc (NASDAQ:FLKS), Black Box Corporation (NASDAQ:BBOX), DRDGOLD Ltd. (ADR) (NYSE:DRD), and Lee Enterprises, Incorporated (NYSE:LEE). All of these stocks’ market caps are closest to VCYT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FLKS | 4 | 1968 | -3 |

| BBOX | 10 | 17647 | 1 |

| DRD | 6 | 12883 | 2 |

| LEE | 10 | 8969 | 1 |

As you can see these stocks had an average of 7.5 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $18 million in VCYT’s case. Black Box Corporation (NASDAQ:BBOX) is the most popular stock in this table. On the other hand Flex Pharma Inc (NASDAQ:FLKS) is the least popular one with only 4 bullish hedge fund positions. Veracyte Inc (NASDAQ:VCYT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BBOX might be a better candidate to consider taking a long position in.

Disclosure: None