The elite funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Baidu.com, Inc. (ADR) (NASDAQ:BIDU) from the perspective of those elite funds.

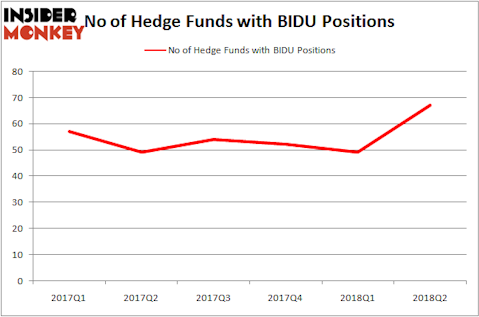

Is Baidu.com, Inc. (ADR) (NASDAQ:BIDU) going to take off soon? Money managers are in an optimistic mood. The number of bullish hedge fund positions increased by 18 recently. Baidu.com was also the 29th most popular stock among hedge funds at the end of the second quarter (see the list of 25 most popular stocks among hedge funds).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a peek at the new hedge fund action encompassing Baidu.com, Inc. (ADR) (NASDAQ:BIDU) before talking about whether Baidu is a good stock to buy now.

Hedge fund activity in Baidu.com, Inc. (ADR) (NASDAQ:BIDU)

Heading into the third quarter of 2018, a total of 67 of the hedge funds tracked by Insider Monkey were long this stock, a change of 37% from the previous quarter. On the other hand, there were a total of 49 hedge funds with a bullish position in BIDU at the beginning of this year. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

More specifically, value investor First Pacific Advisors was the largest shareholder of Baidu.com, Inc. (ADR) (NASDAQ:BIDU), with a stake worth $502.8 millions reported as of the end of June. Trailing First Pacific Advisors LLC was Fisher Asset Management, which amassed a stake valued at $419 millions. Punch Card Capital, Sloane Robinson Investment Management, and Folger Hill Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers have been driving this bullishness. Folger Hill Asset Management, managed by Solomon Kumin, created the largest position in Baidu.com, Inc. (ADR) (NASDAQ:BIDU) in relation to other stocks in its portfolio. Folger Hill Asset Management had $5.6 million invested in the company at the end of the quarter. Anand Desai’s Darsana Capital Partners also made a $170.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Will Graves’s Boardman Bay Capital Management, Manoneet Singh’s Kavi Asset Management, and David Halpert’s Prince Street Capital Management.

Let’s check out hedge fund activity in other stocks similar to Baidu.com, Inc. (ADR) (NASDAQ:BIDU). We will take a look at Eni SpA (ADR) (NYSE:E), Starbucks Corporation (NASDAQ:SBUX), Itau Unibanco Holding SA (ADR) (NYSE:ITUB), and Vale SA (ADR) (NYSE:VALE). This group of stocks’ market valuations are closest to BIDU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| E | 7 | 62908 | 3 |

| SBUX | 42 | 674222 | 2 |

| ITUB | 15 | 802270 | 0 |

| VALE | 32 | 2203817 | 5 |

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $936 million. That figure was $5187 million in BIDU’s case. Starbucks Corporation (NASDAQ:SBUX) is the most popular stock in this table. On the other hand Eni SpA (ADR) (NYSE:E) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Baidu.com, Inc. (ADR) (NASDAQ:BIDU) is more popular among hedge funds.

Baidu shares sold off along with other Chinese technology stocks. The company is growing its earnings at a 20% clip, yet trade at a forward price-earnings ratio of 18. It’s not hard to see why value investors are buying this stock. We see at least 20% upside potential in Baidu as investors recognize that trade wars won’t materially impact BIDU’s earnings and growth rates.

Disclosure: None. This article was originally published at Insider Monkey.