During the midst of the US heat wave and widespread drought last July, I wrote, “Are Irrigation Stocks Raining Profits?” That article covered the two publicly-traded agricultural irrigation stocks: Valmont Industries, Inc. (NYSE:VMI) and Lindsay Corporation (NYSE:LNN).

Last year’s record warm temperatures and drought conditions combined with favorable agricultural economics (record or near-record plantings and commodity prices) increased demand for irrigation systems, as well as fertilizers and water. Thus, the stocks of many companies involved in those industries performed well in 2012.

Spring is just around the corner – and so is planting season for corn and other crops. (Prime corn planting season in the Midwest typically begins about April 15, with early planting beginning April 1.)

So, it’s a good time to check how the irrigation stocks have performed since my July piece, and the lay of the land (pun intended) as we head into the 2013 agricultural season. But first, a snapshot of the industry and each company:

Center Pivots: Pivotal to Global Agricultural Irrigation

Center pivot systems are the gold standard in agricultural irrigation. They are highly engineered, and can be quite high-tech. Some are equipped with GPS capabilities, for instance.

They provide considerable advantages over older methods as they conserve water, energy, and labor while increasing or stabilizing crop production.

There are only five companies manufacturing center pivots, and the four largest — Valmont, Lindsay, T-L Irrigation, and Reinke — are all based in Nebraska.

Valmont Industries, Inc. (NYSE:VMI) owned the original center pivot patent, though naturally competitors flooded in when it expired. Most competitors quickly dropped out — a good sign for potential investors, as it indicates a decent moat.

Valmont Industries — The World Leader

Valmont Industries, Inc. (NYSE:VMI) is the world leader in mechanized irrigation equipment for agriculture.

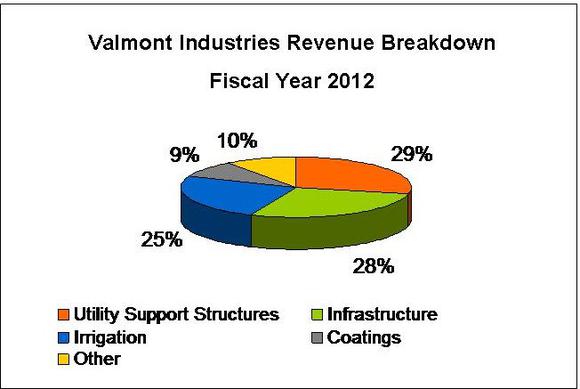

It’s quite diversified, as the chart shows. The Utility segment’s concrete and fabricated metal products are heavily used in electrical transmission applications. Infrastructure’s products are used in lighting, highway safety, wireless, and other applications. Coatings provides hot-dip galvanizing and other coatings services.

Its cash cows are Utility Support and Irrigation. Valmont’s overall operating margin for F/C Q4 2012 was 13.7%. Utility Support’s and Irrigation’s margins were 18.7% and 19.9%, respectively.

Data obtained from Q4/Year 2012 earnings release. Fiscal yr ends Dec.

Lindsay Corp. — The (Close to) Pure Play

Lindsay Corporation (NYSE:LNN) also sells its irrigation systems internationally. The Infrastructure segment sells products to public transportation entities, road contractors, etc.

Data obtained from Q4/Year 2012 earnings release. Fiscal yr ends Aug.

Valmont & Lindsay: Raining Profits

Since Summer Drought: Left Ag Industry & Market High & Dry

The chart shows how the irrigation stocks performed in the nearly eight months since my July 20 article. For context, also included are powerhouse agricultural equipment maker, John Deere & Co.; PowerShares Global Agriculture Portfolio, an ETF based on the NASDAQ OMX Global Agriculture Index; and the market in general.

Lindsay Corporation (NYSE:LNN) and Valmont Industries, Inc. (NYSE:VMI) trounced the market by 96% and 49%, respectively. Deere matched Valmont’s performance.

What rained on the Ag ETF’s stock parade?

Fertilizers. Almost without exception, fertilizer stocks have under-performed the market since last summer. The ETF’s top ten holdings, as of March 13, include Mosaic (up 9.9% since July piece), Potash (-9%), Agrium (8.5%), and CF Industries (0.9%).

Flooding Profits Over 10-Year Period, Too

Here’a a long-term perspective. (PAGG, the ETF, was started in 2008.)

This chart shows how cyclical these stocks are. However, even with the huge price drops during the Great Recession (in gray), it took Valmont only about three years to reach (before it went on to surpass) its previous high and Deere about five years. These figures underscore the case for buy-and-hold long-term investing, even for highly cyclical stocks. The caveat: as long as one selects solid stocks initially.

Ag Irrigation Stocks: Going Forward

2013 Season Outlook:

Early data indicates the 2013 agricultural season will be strong, as both companies had record backlogs for irrigation systems in the previous quarter. Additionally, many of the same factors that existed in 2012 exists: anticipated record planting; drought, or at least very dry conditions, in some agricultural regions.

As per a recent Business Week article, “The combined plantings of wheat, corn and soybeans in the U.S. this year may be the most since 1982 and corn and soybean harvests could be the biggest ever, Glauber said last month at the USDA’s annual outlook forum.” Joe Glauber is the USDA’s Chief Economist.

The long-term drivers are drivers for 2013, too.

Long-Term Growth Drivers:

1. US (& Global) Warming Trend

We’re in a long-term warming trend. People may disagree about the cause, but that’s not relevant here.

The fact that it’s getting warmer means water efficiency, which has always been an important factor for those engaged in agriculture, is becoming increasingly critical. This is a positive for companies manufacturing center pivots, as they are the most efficient form of irrigation.

2. More Mouths to Feed

The global population is ballooning. All those “new” people need to eat, so more food is needed. More acreage is needed to grow more food; that new area will need irrigation systems.

Additionally, the more the population expands, the less acreage is available for farming. So, increasing yields within a given area is also becoming more crucial. Also, much of the most desirable areas for farming already is used for farming, so less desirable areas are being converted to agricultural use. Water efficiency is critical with both factors.

Bottom Line

Valmont and Lindsay Corporation (NYSE:LNN) continue to look like promising investments given the long-term growth drivers discussed above.

Valmont would likely better suit most individual investors given its more diversified, and its stock price is less volatile. (A main negative is its large debt load, which Part 2 will cover.) Those who keep a closer eye on their holdings might want to consider Lindsay.

Stay tuned for a quantitative analysis on these companies that slices & dices the numbers.

The article Irrigation Stocks — A Pre-Planting Season Check-up originally appeared on Fool.com and was written by BA McKenna.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.