Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is UnitedHealth Group Inc. (NYSE:UNH), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

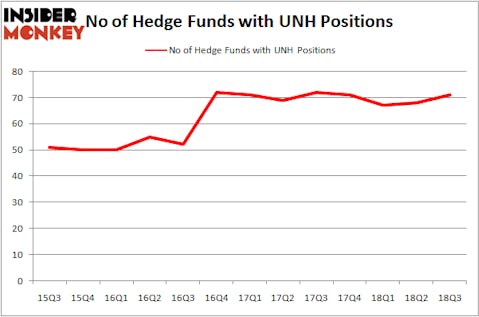

One of the 5 Best Dental Insurance Stocks To Buy Heading Into 2019, hedge fund ownership of UnitedHealth Group Inc. (NYSE:UNH) has been among the most stable of any stock for nearly two years, hovering within a narrow range in terms of number of shareholders. That’s particularly true for one of the 30 Most Popular Stocks Among Hedge Funds in Q3 of 2018, which have the most shareholders and generally tend to have the most turnover as well. Not so with UnitedHealth, which hedge funds are loving and holding on to.

Today there are dozens of formulas investors employ to appraise publicly traded companies. A pair of the best formulas are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the top investment managers can outperform the market by a significant amount (see the details here).

Hedge fund activity in UnitedHealth Group Inc. (NYSE:UNH)

Heading into the fourth quarter of 2018, a total of 71 of the hedge funds tracked by Insider Monkey were long this stock, a 4% rise from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in UNH over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Eagle Capital Management held the most valuable stake in UnitedHealth Group Inc. (NYSE:UNH), which was worth $1.35 billion at the end of the third quarter. On the second spot was Lone Pine Capital which amassed $802.8 million worth of shares. Moreover, AQR Capital Management, Egerton Capital Limited, and Adage Capital Management were also bullish on UnitedHealth Group Inc. (NYSE:UNH), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, specific money managers were breaking ground themselves. Highbridge Capital Management, managed by Glenn Russell Dubin, assembled the most valuable position in UnitedHealth Group Inc. (NYSE:UNH). Highbridge Capital Management had $10 million invested in the company at the end of the quarter. Peter Muller’s PDT Partners also made a $8.9 million investment in the stock during the quarter. The following funds were also among the new UNH investors: David Costen Haley’s HBK Investments, John Burbank’s Passport Capital, and Benjamin A. Smith’s Laurion Capital Management.

Let’s also examine hedge fund activity in other stocks similar to UnitedHealth Group Inc. (NYSE:UNH). These stocks are Nestlé S.A. (OTCMKTS:NSRGY), Wells Fargo & Co (NYSE:WFC), Mastercard Inc (NYSE:MA), and AT&T Inc. (NYSE:T). All of these stocks’ market caps are similar to UNH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NSRGY | 5 | 1575298 | 0 |

| WFC | 79 | 29963465 | 6 |

| MA | 95 | 10068933 | 7 |

| T | 70 | 3763139 | -24 |

As you can see these stocks had an average of 62 hedge funds with bullish positions and the average amount invested in these stocks was $11.34 billion. That figure was $6.42 billion in UNH’s case. Mastercard Inc (NYSE:MA) is the most popular stock in this table. On the other hand Nestlé S.A. (OTCMKTS:NSRGY) is the least popular one with only 5 bullish hedge fund positions. UnitedHealth Group Inc. (NYSE:UNH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal and we love how stable the hedge fund ownership of this stock is, which may make it worth considering for a long-term place in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.