Keith Weiss: Got it. And then one follow-up and I think this is probably for Rob. In terms of net new customer growth, it looks pretty weak in the quarter, like, just overall, net new customer growth at like 150. That’s the lowest that we have seen since you guys have gone public and even the customer is over 100,000. This is — it was a relatively small increase versus what we have seen historically. Is this part and parcel of the distribution changes or more of a macro impact and how should we think about kind of the pace of the ability to sort of recover and accelerate that pace of net new customer has on a go-forward basis?

Rob Enslin: Yeah. So when you look at it, Keith, I mean, the majority of the churn is in the smaller customers. If you remember the chart that we showed at Investor Day shows that we have to move those customers from the left to the right. We feel really confident that we actually — that’s actually happening and that we are getting more success with more positive signs in the Global 2000 and that’s going to continue to be our focus and that’s how the segmentation is actually set up. We will move more over time into the distribution side with the smaller customers and you should expect to see churn in smaller — in the smaller customer market.

Keith Weiss: Got it. So like the retention rate remains really strong, but the smaller customers that probably the customer retention rate is kind of we are seeing the impact of that on the net new customer adds?

Rob Enslin: Yeah.

Keith Weiss: Got it. Excellent. Okay.

Rob Enslin: Thank you.

Operator: Our next question comes from Kirk Materne with Evercore. Please state your question.

Chirag Ved: Hi. This is Chirag on for Kirk. Thanks for taking the question and congratulations on the strong quarter. Just one question for me around the reception of the automation platform. So how deep would you say you all are in terms of customer adoption of the overall end-to-end automation platform today within your existing customer base and largest customers when we are talking beyond core RPA use cases and how are you continuing to pursue the opportunity to go deeper? And maybe if you could call out any specific areas that are carrying more weight or seeing more demand? Thank you.

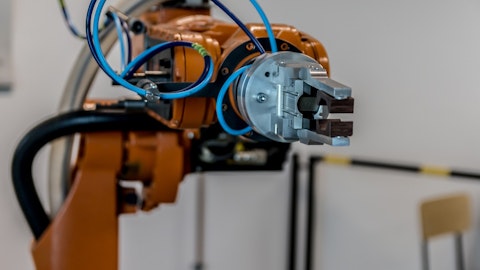

Rob Enslin: Yeah. So, obviously, we feel very positive about the business platform and what we can achieve with the business platform and we see significant future positive signs in terms of the customer opportunity that we have in front of the team with existing customers to expand. If you just look at the expansion, you can see with Bank of New York Mellon, ATA customers expanding to the full platform and we see many, many more opportunities in that space. It’s clear that solution sets like test is have — will have a big impact and it can be a significant driver. So it’s clear that Document Understanding is a significant driver of the platform. And we believe with our Process Mining and Task Mining, as we described with Total Quality Logistics that the broader platform is now starting to have an impact and it’s pretty clear in our customer conversations that the platform is the way to go for automation.

So we feel really strong about where we are headed. How it’s tied to our NorthStar strategy, our selection of packages or doing packages in our platform pricing. Early days, but really confident about how we have laid it out and how we are starting to execute.

Daniel Dines: Yeah. This is Daniel. I would like to add that if you look from an perspective, our platform strategy, it allowed us to move from our traditional market of automating existing manual processes and to growing more to end-to-end process automation. So we are the only company that has a platform that covers the entire spectrum of automation from large business processes to manual repetitive processes to even micro test that people are doing as part of their daily job.

Operator: Thank you. And our next question comes from Bryan Bergin with Cowen. Please go ahead.

Bryan Bergin: Hi. Good afternoon. Thank you. It’s good to hear some of the early go-to-market initiatives here having some success and I am curious on that, how the land size on some of the new deals are comparing to before, I know it’s early, but I think the company had talked about an average land size of 15,000 to 25,000 in the past. Can you just give us any sense on how we should be thinking about the average land size under this new approach, just as you cite some of these notable new third quarter deals?