Since June 2016, Europe (and the rest of the world) has been facing one major uncertainty – Brexit. On June 23, voters in the UK chose for the country to leave the European Union. Even though a lot of things have happened since then, Brexit has always been among the main topics covered by the media.

Under the current rules, the UK must leave the EU on March 29. For the past two years, the UK prime minister Theresa May has been negotiating with EU leaders the conditions of the exit and the path forward to ensure a good collaboration between the UK and the bloc. In November, May finally reached an agreement with the EU. However, the deal hit a major snag on January 15. The deal failed to be approved by the British Parliament. What’s more, the defeat was the biggest in the UK’s history for a sitting government, as 432 lawmakers rejected the deal against 202 that voted in favor.

How European Financial Markets Reacted to The Brexit Deal Vote?

The Brexit deal brought some degree of trouble for the European stock markets. US-traded Vanguard FTSE Europe Index Fund ETF (NYSEARCA:VGK), which includes some of the largest European companies, lost around 2% since the deal was announced on November 13 and until the vote was held on January 15. A similar trajectory could be observed by iShares MSCI Eurozone ETF (BATS: EZU), which includes mid- to large-cap companies from the eurozone, and iShares Core MSCI Europe ETF (NYSEARCA:IEUR), which includes small-, mid-, and large-cap companies from Europe.

However, following the vote’s failure, European stocks gained some ground and even the pound recovered the losses it suffered hours before the vote. However, it is too early to celebrate, because it’s likely that investors’ reaction to the vote’s failure will escalate as the world understands what the rejection of the deal means for Brexit.

Analysts believe that investors took the rejection of the deal as a sigh of relief following weeks of uncertainty after the agreement was reached in November. In addition, some took the failure to pass a Brexit deal as a sign that the UK’s exit from the EU can be delayed or even cancelled altogether. However, the cancelation is unlikely given that a day after the Brexit deal vote, Theresa May and her government won the no-confidence vote from the Labour Party.

Worst Case Scenario for Financial Markets – No Deal Brexit

Therefore, currently there are two most popular scenarios being discussed – a delayed Article 50 (the provision that allows the UK to leave the EU) or a no-deal Brexit. The delay could also allow for a broader discussion about cancelling Brexit altogether. A no-deal Brexit will also require a vote from lawmakers, but given the devastating consequences it will cause, experts consider that it’s highly unlikely to pass.

A no-deal Brexit could have devastating consequences for the UK. It could crush the pound, businesses will be affected since there will be no agreements between the two parties regarding trade, customs, and travel. Some even warn about disastrous consequences like food shortages, medicine shortages, which could in turn cause civil unrest.

There is a chance that the UK and the EU would negotiate some smaller deals on how to act in the case of a no-deal Brexit scenario. However, EU officials said that the current deal will not be renegotiated, but they also expressed willingness to allow the UK to cancel Brexit.

In addition to a falling pound, the London Stock Exchange would also plunge. However, the magnitude would spread around the world. Food companies like Nestle SA ADR (OTCMKTS:NSRGY) and airline operators such as Ryanair Holdings plc (NASDAQ:RYAAY) are likely to be the victims of the ensuing bloodbath. Car makers like Ford Motor Company (NYSE:F) and Volkswagen AG ADR (OTCMKTS:VWAPY), which have facilities in the UK, will also be affected due to the potential parts shortages and sales drops that would result from the decline in the UK economy.

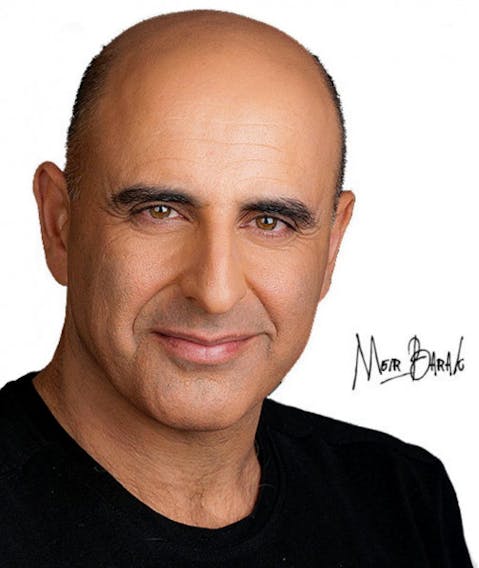

Tradenet’s Meir Barak believes increased volatility is the biggest concern for traders. ‘My students and I trade British stocks very seldom, as we only trade New York listed stocks. Many UK stocks are indeed traded in New York, but tend to have large gaps as they are dually listed. For us, Tradenet.com day traders, the biggest impact from Brexit’s impasse for us so far is the volatility it adds intraday, as news from London keep rolling in during New York trading hours,’ said Barak.

How Small Investors Should Deal?

Amid a lot of uncertainty surrounding Brexit and other issues that our world is currently facing, small investors are taking major risks, as there is no clear direction for the stock markets. One way to address the uncertainty is to ignore it. This doesn’t mean to go with the gut, but rather to focus on an investing strategy that doesn’t take it into account. We are talking about technical analysis. Because it focuses on numbers, technical analysis doesn’t care about the intrinsic value of securities that might be affected by such developments as the Brexit.

Before the Brexit vote, many analysts were suggesting investors to ignore the warnings and to buy stock, because the vote would definitely be in favor of the UK remaining in the EU. At the same time, many technical analysts suggested that the trends warranted either a sale or taking a bearish approach. In the end, after the vote, a lot of people lost their fortunes, while some walked away with their pockets full of cash.

While technical analysis seems like a complex science, there are plenty of resources to learn how to navigate the stock charts. For example, Tradenet Day Trading Academy offers a range of courses on technical analysis and has a 14-day money back guarantee. Moreover, the founder of the company, Meir Barak has a YouTube Channel, where he explains some aspects of technical analysis and conducts daily live streams of his trading.

Conclusion

The turbulence in European (and global) financial markets following the failed Brexit vote is likely to ensue in the coming weeks as more details emerge and it becomes more clear whether the UK will leave Brexit without a deal. In this environment, the best approach for investors with limited capital is to engage in technical trading in order to identify profitable opportunities.

Disclosure: None. This article is originally published at Insider Monkey.