Not everyone is capable of investing their hard-earned savings with successful hedge funds, as many won’t accept your cash money unless you commit at least $5 million. However, if you’re not fortunate enough to be that wealthy, hedge funds and other big asset managers can still do the due diligence and equity research for you, through their highly-skilled finance teams and vast resources. All you have to do is track their filings to see the latest moves made by these skilled investors, which is exactly what we do at Insider Monkey. In that vein, let’s take a look at the third quarter performance achieved by Christopher Pucillo‘s Solus Alternative Asset Management LP and analyze some of its prominent holdings.

As of June 30, Solus Alternative Asset Management held five long positions in companies valued at $1 billion or more (we do not count positions in micro-cap stocks, as they tend to be illiquid and volatile). Those five positions enjoyed weighted average returns of 23.1% during the quarter, helping Solus rebound from what had been a difficult first-half of the year for its long stock picks, with losses in each of the first two quarters for those picks. As a disclaimer, please bear in mind that our calculations may be different from the fund’s actual returns, as they do not include changes to positions during the third-quarter, or positions that don’t get reported in 13F filings, like short positions.

Now then, let’s take a look at four of the five long positions held by Solus in $1 billion+ companies on June 30 and see how they performed in the third quarter.

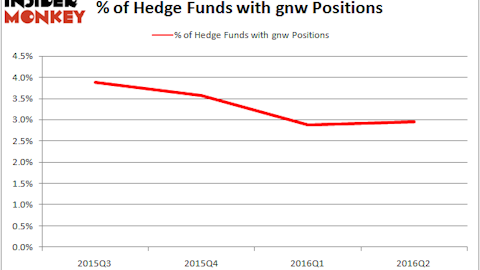

We’ll start with Visteon Corp (NYSE:VC), Solus Alternative’s top stock pick at the end of June. Solus hiked its position in the stock by 30% during the second quarter, lifting its stake to 1.3 million shares. Shares of the auto parts supplier gained just under 10% during the quarter, but are down by 40% this year. Other hedge funds tracked by Insider Monkey have not been as bullish on the stock, as you can see in the chart below, as the percentage of hedge funds with positions has fallen by nearly half over the past four quarter.

A total of 31 of the hedge funds tracked by Insider Monkey were long Visteon Corp (NYSE:VC) on June 30, down from 35 at the end of March. David Cohen and Harold Levy’s Iridian Asset Management had the number one position in Visteon Corp (NYSE:VC) among those funds at the end of the second quarter, worth close to $201.1 million. Some other funds that were bullish on the stock were First Eagle Investment Management, Jim Simons’ Renaissance Technologies, and Cliff Asness’ AQR Capital Management.

Follow Visteon Corp (NASDAQ:VC)

Follow Visteon Corp (NASDAQ:VC)

Receive real-time insider trading and news alerts

Let’s move on to Travelport Worldwide Ltd (NYSE:TVPT), which was replaced as the fund’s top pick by Visteon during the second quarter, after taking it from Visteon during the first quarter. Solus trimmed its stake in Travelport by 5% during the second quarter, leaving it with 6.90 million shares. Travelport Worldwide Ltd (NYSE:TVPT)’s shares trended up throughout the third-quarter, gaining nearly 17% during that time. However, they’ve been hit hard in November after the release of the company’s latest earnings report and guidance for its full fiscal year, with the latter coming in beneath the estimates for both revenue and income at the mid-points of the range.

28 of the hedge funds tracked by Insider Monkey held long positions in Travelport Worldwide Ltd (NYSE:TVPT) at the end of June, including Angelo Gordon & Co, managed by John M. Angelo and Michael L. Gordon ($103 million position), Parag Vora’s HG Vora Capital Management, Amit Nitin Doshi’s Harbor Spring Capital, and Edward A. Mule’s Silver Point Capital.

Follow Travelport Worldwide Ltd (NYSE:TVPT)

Follow Travelport Worldwide Ltd (NYSE:TVPT)

Receive real-time insider trading and news alerts

We’ll check out two more stock picks of Solus Alternative Asset Management on the next page.