Next up is Genworth Financial Inc (NYSE:GNW), which also helped power Shah Capital to big third-quarter returns. Shares of the company nearly doubled, yet have fallen in the fourth-quarter after it was announced that it would be acquired by China Oceanwide for just $5.43 per share in cash, a premium of less than 5% based on the stock’s price before the deal was announced.

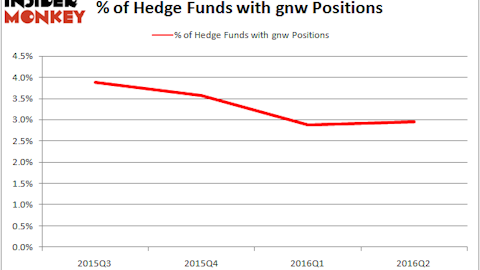

Solus Alternative Asset Management had the most valuable position in Genworth Financial Inc (NYSE:GNW) among the 22 funds in our system long the stock on June 30, holding 15 million shares worth $38.7 million, unchanged quarter-over-quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital held a $19.5 million position. Some other hedge funds and institutional investors with similar optimism concerning Genworth Financial Inc (NYSE:GNW) were Richard S. Pzena’s Pzena Investment Management, Himanshu H. Shah’s Shah Capital Management, and Jim Simons’ Renaissance Technologies.

Follow Genworth Financial Inc (NYSE:GNW)

Follow Genworth Financial Inc (NYSE:GNW)

Receive real-time insider trading and news alerts

Lastly is Globalstar, Inc. (NYSEMKT:GSAT), which was a $1 billion+ company on June 30, but has since fallen below that mark, boasting a market cap of $894 million. Shares spiked as high as $2.75 in mid-May, or over three-times their current value. Shares ended up flat for the third-quarter, but have lost over 42% this year. Solus’ position in the stock was a new one opened during the second quarter, and consisted of 4.5 million shares valued at $5.45 million.

Solus was one of a net total of five hedge funds in our system to add the stock to their portfolios during the second quarter, as it was held by 20 funds at the end of period, up from 15 at the beginning of it. When looking at the institutional investors followed by Insider Monkey, Michael Johnston’s Steelhead Partners had the number one position in Globalstar, Inc. (NYSEMKT:GSAT), worth close to $32.9 million, amounting to 3.4% of its total 13F portfolio. The second-largest stake was held by York Capital Management, led by James Dinan, holding a $17.4 million position. Other hedge funds and institutional investors that were bullish on Globalstar, Inc. (NYSEMKT:GSAT) included Mark Weissman, Adam Cohen and David Coleto’s Caspian Capital Partners, Buckley Ratchford’s Wingspan Investment Management, and D E Shaw, founded by David E. Shaw.

Follow Globalstar Inc. (NASDAQ:GSAT)

Follow Globalstar Inc. (NASDAQ:GSAT)

Receive real-time insider trading and news alerts

[/company-follow-email

Disclosure: None