In this article, we will discuss the Top 10 Transportation and Industrial Stocks to Buy Now.

As per PwC, deal activity in the broader transportation and logistics (T&L) sector was consistent in early 2025 versus the same period in 2024. In the US, deal volume remained muted, with companies tackling sustained macroeconomic pressure, policy changes, and volatile geopolitical conditions. That being said, T&L leaders have been focusing on strategic alignment over volume, and subsectors such as airfreight, logistics, and marine ports and terminals continue to attract the most interest, added the firm.

Key Trends Affecting Broader Transportation and Industrial Sector

The US factory production hardly increased in May, with an increase in motor vehicle and aircraft output partially being offset by weakness elsewhere, as highlighted by Reuters. Furthermore, the outlook for manufacturing is eclipsed by tariffs. Reuters noted that Donald Trump’s shifting tariffs policy remains a headwind to manufacturing, which makes up for 10.2% of the economy and remains dependent on imported raw materials.

However, PwC highlighted that the investor appetite for T&L infrastructure is robust. As per the firm, the carriers continue to focus their portfolios on specialized growth areas possessing robust margins and increased entry barriers like cold chain services, healthcare and pharmaceutical logistics, and reverse logistics, among others.

Amidst such trends, we will now have a look at the Top 10 Transportation and Industrial Stocks to Buy Now.

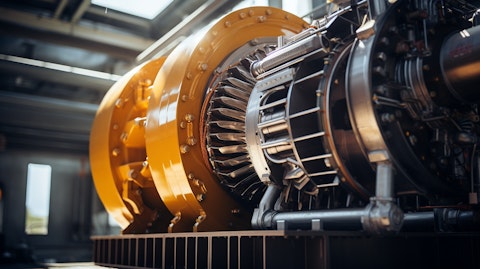

A close-up of a large industrial compressor in the oil and gas industry.

Our Methodology

To list the Top 10 Transportation and Industrial Stocks to Buy Now, we used a screener to shortlist the stocks catering to the broader transportation and industrials sector. Next, we chose the ones popular among hedge funds. Finally, the stocks were ranked in ascending order of their hedge fund sentiment, as of Q1 2025.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

Top 10 Transportation and Industrial Stocks to Buy Now

10. Heartland Express, Inc. (NASDAQ:HTLD)

Number of Hedge Fund Holders: 18

Heartland Express, Inc. (NASDAQ:HTLD) is one of the Top 10 Transportation and Industrial Stocks to Buy Now. Baird resumed coverage of the company’s stock with a “Neutral” rating and a price objective of $9. The firm is resuming its coverage on the broader trucking, logistics, and rail sectors. It has a constructive, but balanced view of the near-term risks as well as earnings prospects. As per the analyst, while the balance of 2025 remains uncertain, the conditions that tend to precede a turn remain largely in place.

The company’s Heartland Express brand remained profitable during the 3 months ended March 31, 2025. However, it did not reflect the operating ratio and financial results that it expected and delivered over the previous periods. It believes that Heartland Express continued to operate in line with the best full truckload carriers in the industry.

Heartland Express, Inc. (NASDAQ:HTLD) has been strategically shrinking its fleet to right-size to freight demand, along with evaluating all the cost measures for opportunities for efficiency. Heartland Express, Inc. (NASDAQ:HTLD) opines that cost improvements and transportation system changes, which are already underway or planned for each of the brands, can provide a better cost structure and operating visibility to deliver a path towards operating profitability for the company’s consolidated operations.

Heartland Express, Inc. (NASDAQ:HTLD) operates as a short, medium, and long-haul truckload carrier and transportation services provider. Palm Valley Capital Management, an investment management firm, released its Q1 2025 investor letter. Here is what the fund said:

“During the period, we added to our weightings in Kelly Services (ticker: KELYA), Resources Connection (ticker: RGP), and Heartland Express, Inc. (NASDAQ:HTLD). We increased our exposure to Heartland Express on share price weakness. The business continues to generate free cash flow, and we believe the trucking industry will recover from its cyclical trough.”