An increasing number of analysts are starting to believe that the AI-led bull market has more room to run amid new catalysts like the Fed’s rate cuts and strong earnings from major companies. Peter Oppenheimer, Chief Global Equity Strategist at Goldman Sachs, said in a recent interview with CNBC that the current bull market is driven by tech companies with strong profits, and we are not in a bubble yet.

“For sure we’ve had a strong period of returns, particularly driven by tech stocks in the US. But the first thing to bear in mind is that that is not related to AI specifically. That’s become the increasingly strong narrative. But actually the tech stocks and the US market driven by them have been outperforming for 15 years and that’s been completely underpinned by extremely strong profit growth,” the analyst said. “So as yet this dominance of these large companies and the tech sector in particular has really been based on fundamentals not speculation or irrational exuberance about the future. So I think it’s really supported by fundamentals so far. Of course that could change as speculation builds but I don’t think we’re in a bubble at this stage.”

READ ALSO: 7 Best Stocks to Buy For Long-Term and 8 Cheap Jim Cramer Stocks to Invest In.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 427.7% since May 2014, beating its benchmark by 264 percentage points (see more details here).

10. Adtran Holdings Inc (NASDAQ:ADTN)

Number of Hedge Funds Investors: 28

Adtran Holdings Inc (NASDAQ:ADTN) is a fiber networking and telecommunications company selling networking solutions. Chris Retzler, Needham portfolio manager, recently talked about the stock during a program on CNBC and said it’s one of his favorite small-cap picks. Here is what he said:

“Another name we think where… money is finally going to begin to flow into rural broadband buildout is a company that’s really not moved with the market at all called Adtran. We think it’s good value.”

The analyst said the stock has a “catalyst” coming in the near future.

9. Badger Meter Inc (NYSE:BMI)

Number of Hedge Funds Investors: 32

Badger Meter Inc (NYSE:BMI) makes flow measurement, quality and control solutions. It sells utility water smart metering solutions and software technologies. Talking about his favorite small-cap picks, Chris Retzler, Needham portfolio manager, said the following in a recent interview on CNBC:

“Badger Meter Inc (NYSE:BMI), which is a water meter business where meters run out over time. It’s water utilities, and with infrastructure being built out, we think that Badger Meter is a really well-run company.”

The Brown Capital Management Small Company Fund stated the following regarding Badger Meter, Inc. (NYSE:BMI) in its Q1 2025 investor letter:

“In the first quarter of 2025, we added three companies, Badger Meter, Inc. (NYSE:BMI), Red Violet (RDVT) and TransMedics (TMDX). Badger Meter makes water meters and other devices primarily for water utilities to measure usage by its customers and to monitor conditions across its system. In an industry that has historically grown in the single digits, Badger Meter has generated a revenue compound annual growth rate of 14% over the last five years. The company has achieved this growth rate primarily by 1) adding layers of technology on top of traditional monitoring systems and 2) by improving the accuracy and capabilities of its advanced meters which are replacing aging conventional meters in water system infrastructure. Badger’s technology advancements include optimizing the transmission of usage data from meters and using sensors to monitor water pressure across the system, to detect leaks and to perform in-line testing of water quality. All of this data flows into Badger’s robust analytics software platform, which allows water-utility customers to have better visibility across their entire system and make better decisions. The company has a strong balance sheet with $295 million in cash and no debt and has been profitable for many years. With $827 million in revenue in 2024, we believe Badger Meter has a long runway for growth as it sells into a total addressable market which we estimate to be around $20 billion and growing.”

8. Generac Holdings Inc (NYSE:GNRC)

Number of Hedge Funds Investors: 51

Chris Retzler, Needham portfolio manager, said in a recent program on CNBC that small-cap stocks have strong growth potential amid the Fed’s rate cut cycle. He believes money will “flow” into small-cap stocks in the near future. Generac Holdings Inc (NYSE:GNRC) is one of the favorite picks of the analyst. The company makes backup power generation products for residential, light commercial and industrial markets. Here is why the analyst likes the stock:

“Generac is one, as you mentioned. They have a data center play where they have diesel backup generation, and they’re coming out with new products there that would be competing with some of the incumbents. But the demand for backup generation is sizable for data centers.”

Diamond Hill Small-Mid Cap Fund stated the following regarding Generac Holdings Inc. (NYSE:GNRC) in its second quarter 2025 investor letter:

“Despite markets’ relatively sharp bounce following April’s downward volatility, we were able to initiate several new positions in the quarter at what we consider compelling valuations: Generac Holdings Inc. (NYSE:GNRC), Alaska Air Group, Knife River Corporation, Taseko Mines, Century Communities and FTI Consulting.

Generac Holdings is a leading energy technology solutions manufacturer with a dominant position in residential home standby power and a diverse offering of energy solutions. We anticipate the combination of increasing electricity usage and electrical grid instability will drive growing demand for Generac’s products. While the market seems to have focused on near-term consumer weakness and potential tariff-related headwinds, we believe the long-term outlook is constructive and capitalized on a discounted valuation relative to our estimate of intrinsic value to initiate a position.”

7. ASML Holding NV (NASDAQ:ASML)

Number of Hedge Funds Investors: 78

Anneka Treon, ING global head of private banking, said in a latest program on CNBC that ASML Holding NV (NASDAQ:ASML) is an “exciting” investment. She was commenting on the program’s host’s assertion that Nvidia could not “exist” without ASML Holding NV (NASDAQ:ASML).

“You need those EUV machines,” Treon said. “I think it’s an exciting investment. Essentially, innovation is an exciting place to invest in, and I think we can overthink, we can be skeptical, we can be cynical. However, if we zoom out and look at what is going on in markets, what are markets offering? Let’s take the US for example. You’re seeing easier monetary policy, you’re seeing easier fiscal policy, you’re seeing strong earnings growth, and you’re seeing capex booms. So, you don’t need to be too obsessed about one of the four. The general backdrop is very accommodating and very helpful.”

Bristlemoon Global Fund stated the following regarding ASML Holding N.V. (NASDAQ:ASML) in its third quarter 2025 investor letter:

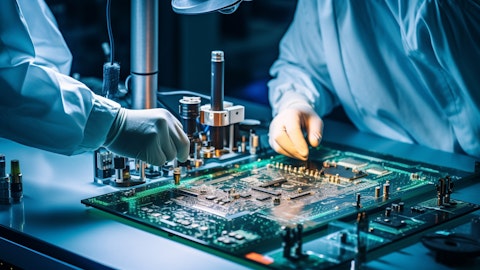

“ASML Holding N.V. (NASDAQ:ASML) is a Dutch company that develops, assembles and sells photolithography (“litho” or “lithography”) machines that are used to print integrated circuit designs onto silicon wafers during the semiconductor fabrication process. ASML is the sole supplier of Extreme Ultraviolet (EUV) lithography machines that are used by the likes of TSMC and Intel to fabricate the most advanced chips for AI, smartphones and computing. It also has an effective monopoly over Deep Ultraviolet (DUV) machines which are the primary litho workhorses within a fab.

There is plenty of material in the public domain explaining why ASML is a one-of-a-kind business, so we won’t belabour the point here. Instead, we want to focus on why the opportunity to buy this business at a steep discount existed in the first place considering the AI investment boom taking place, and where our views diverged from the market.

Since attaining an all-time high of €1,002 in mid-2024, ASML subsequently experienced a -45% drawdown at the Liberation Day trough and has otherwise trodden water in the ~€700 range. A disastrous Q2 2025 earnings call where CEO Christophe Fouquet volunteered that ASML “cannot confirm” growth in 2026 despite no one asking him about 2026 further amped up the bearish narrative to eleven…” (Click here to read the full text)

6. Intel Corp (NASDAQ:INTC)

Number of Hedge Funds Investors: 82

Michael K. Farr, founder and CEO of Farr, Miller & Washington LLC, said in a recent program on CNBC that there are several tailwinds “on our back” and the current AI bull market could continue despite “warning signs.” The analyst also talked about Intel Corp (NASDAQ:INTC):

“We should look at some of the companies the government is buying and supporting. There are a couple of lithium companies, for instance, Intel. As we set floors and things, this is a new day in the US where the government is getting involved in individual companies. Maybe we need to make sure we own them as well as the government.”

5. Snowflake Inc (NYSE:SNOW)

Number of Hedge Funds Investors: 100

D.A. Davidson’s Gil Luria explained in a recent program on CNBC how AI is helping companies like Snowflake Inc (NYSE:SNOW). The analyst has a Buy rating on the stock and a $275 price target.

“I would say that it really hasn’t changed the markets for a lot of these companies, especially in the application software, quite as much as the narrative is, and it may take time for the markets to change as well. This is a technology that’s actually not a great fit for business software. Business software is very precise. It’s very integrated. There’s workflows, permissions, connections. So it’s going to take time until new AI software startups are going to disrupt the application software companies in spite of the narratives. But there are places in software where the benefit is very clear. You have to have the data all in one place — that benefits Snowflake Inc (NYSE:SNOW). You have to observe all the applications — that benefits Datadog. You’re developing a lot more code.”

Artisan Mid Cap Fund stated the following regarding Snowflake Inc. (NYSE:SNOW) in its third quarter 2025 investor letter:

“Notable trims in the quarter included Arista Networks, Snowflake and Tyler Technologies. Snowflake Inc. (NYSE:SNOW) is a leading player in data infrastructure, enabling organizations to unlock greater value from their data estates through unified access, scalable analytics and AI-driven insights across cloud environments. Following a strong performance and an elevated valuation, we trimmed our position—reflecting a degree of caution as increasingly powerful and cost-effective large language models raise questions about the long-term evolution of traditional data warehouse architectures and the role of centralized data platforms.”