“If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I’d give it back to you and say it can’t be done.”

-Warren Buffett-

Not too long ago, if you wanted to add a twist to your beverage you would have to measure out the powder and mix it in to your water. It didn’t take long for companies like Kraft Foods Inc (NASDAQ:KFT), owners of Tang, to create pre-measured powder packets that allowed customers to add flavor to their drinks in an easier fashion. The next generation of fruity flavor has come to the market and is even simpler than the pre-measured packets. Now people can keep 32 servings of their favorite beverage enhancer in a pocket sized container.

The world’s largest beverage company is rolling out a new drink that will only need a squirt of flavor to spice up a drink. On Oct 1, The Coca-Cola Company (NYSE:KO) will introduce Dasani Drops, a drink similar to Kraft Food’s MiO, which was introduced in March 2011 and enhances boring beverages with squirts of flavor(Coca-Cola is Warren Buffett’s top holding). Dasani Drops are similar to MiO, and customers can transform their water into juice by squeezing out drops of the potent flavor into their water.

MiO comes in nine flavors and cost about $3.99 a pop. The bottle can fit in to your pocket and is sweetened with sucralose, a calorie-free artificial sweetener that is 600 times sweeter than sugar. Unlike pre-measured powdered drink mixes, people can decide how much they want to squirt in to their water. The pocket-sized container of MiO contains more than 24 servings, and is more cost effective than buying sports drinks, teas, and energy drinks.

Similar to Kraft’s MiO, Dasani Drops uses calorie free artificial sweeteners and will be priced around $4 a bottle (click to see if the Dow dumping Kraft is a bearish signal for the stock). Dasani Drops are expected to be a little larger than MiO, offering about 32 servings, as opposed to 24. Coca-Cola sees a big opportunity for their liquid water enhancer and plans to sell their product nearly everywhere a Dasani water bottle is sold. It shouldn’t be difficult talking vendors into selling the high margin products that offer some of the highest sales per square foot and require no refrigeration.

Kraft was happy to report the success they incurred with their MiO product, which had sales nearly double to more than $100 million through the first nine months of 2012. To measure the growth potential of the liquefied flavor drops, we can look at powdered drink mixers. Kraft’s powdered orange drink Tang has grown to over $1 billion in annual sales. With convenient liquefied flavor drops gaining traction in the market, the mixer has the potential to expand sales to $500 million within the next three years and become a multi-billion dollar industry further down the line. We believe that Coca-Cola will split sales with Kraft, and both companies will rake in the majority of sales in the growing liquefied drink enhancer market.

The new Dasani Drops would be a disappointment if 2013 revenues were below $80-$100 million. This would qualify as only a rounding error in comparison to Coca-Cola’s 2011 sales totals, which were in excess of $46 billion. The new product should begin to have a material impact on sales if it can reach $1 billion in sales, which would then account for over 2% of Coca-Cola’s overall top line.

The drops are clearly a more convenient and easier to use product than the powder packs, and we believe they will begin to slowly push powder out of the market. Assuming the drops don’t disappoint, Coca-Cola should be able to hit a billion in sales from Dasani Drops within the next 10 years.

While the beverage giant would like to see Dasani Drop users purchase a Dasani water to create their beverage, we would be surprised if the introduction of the liquid water enhancer had a material impact on Dasani water sales. The release of the drops may slightly increase Dasani water sales, but that will be offset by the cannibalization of other higher margin drinks like enhanced water and sports drinks. The rollout of the product should include four flavors including strawberry kiwi, pink lemonade, mixed berry, and pineapple coconut, with more fruit flavorings expected next year. These zero calorie flavors should appeal to a vast array of customers ranging from health conscious customers to bargain hunters.

John Roddey, the VP of Coca-Cola’s water, tea and coffee business in North America, believes that there are opportunities that stretch outside of water. If drops can change water to juice, perhaps the next step is changing water to coffee or tea. Although this could be a hint to what we can expect to see in the future for the beverage industry, various questions remain about the nutrients and taste for products extending outside of juice. If these liquefied drops can penetrate other facets of the beverage industry, there’s no limit to the products sales potential.

Coca-Cola sniffed out the revenue opportunity and will begin to take market share from Kraft in the liquefied beverage enhancer market. Now it’s just a matter of time until PepsiCo, Inc (NYSE:PEP) hops into the scene to compete against Coca-Cola (See why Citadel and Eagle Capital Management have large stakes in PepsiCo) and Kraft.

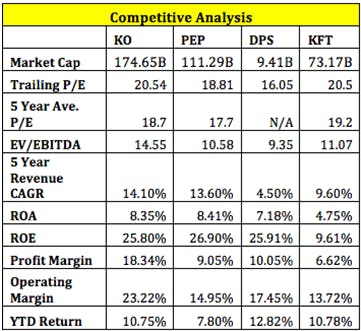

To get a better understanding of where The Coca-Cola Company stands among their peers, I compared them to PepsiCo, Dr. Pepper Snapple Group Inc. (NYSE:DPS), and Kraft Foods. From a valuation standpoint Coca-Cola is more expensive then each peer on a P/E and an EV/EBITDA basis. All these companies seem fairly valued in terms of their trailing P/E relative to their 5-year average P/E.

Looking at revenue growth, Coca-Cola beats all their competitors in terms of their five-year compound annual growth rate (CAGR), and Pepsi is the only other company to have double-digit growth in this category. Moving down to ROA and ROE, Pepsi leads in both categories, while Kraft is last in both. Coca-Cola crushes their comparables in terms of margins, with a profit margin of 18.34% and an operating margin of 23.22%. Both are much higher than Dr. Pepper Snapple Group, who is second in both categories at 10.05% and 17.45%, respectively.

Coca-Cola is more expensive than their competitors, but for the right reasons. In comparison to Pepsi, Dr. Pepper Snapple Group, and Kraft Foods, the largest beverage producer has grown revenues at the fastest rate, and boasts the best margins.

Gaining market share in the non-alcoholic beverage industry has been a constant and international battle between Coca-Cola and Pepsi. Coca-Cola has been the clear leader in international markets, occupying 53.1% market shares, over double than Pepsi’s 21.7%. Coca-Cola has arguably the most recognizable brand name in the world and will continue to dominate the non-alcoholic beverage industry if they can stay on the innovative front.