Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track more than 700 prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile gigantic failures like hedge funds’ recent losses in Valeant. Let’s take a closer look at what the funds we track think about Abbott Laboratories (NYSE:ABT) in this article.

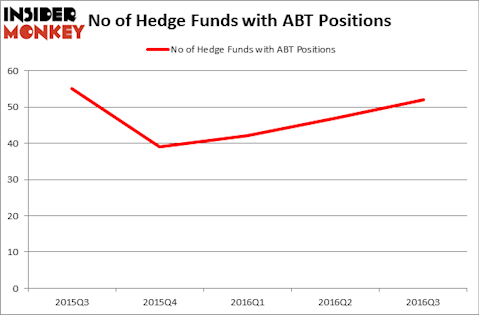

Abbott Laboratories (NYSE:ABT) shareholders have witnessed an increase in activity from the world’s largest hedge funds lately. ABT was in 52 hedge funds’ portfolios at the end of the third quarter of 2016. There were 47 hedge funds in our database with ABT positions at the end of the previous quarter. At the end of this article we will also compare ABT to other stocks including Occidental Petroleum Corporation (NYSE:OXY), Rio Tinto plc (ADR) (NYSE:RIO), and E I Du Pont De Nemours And Co (NYSE:DD) to get a better sense of its popularity.

Follow Abbott Laboratories (NYSE:ABT)

Follow Abbott Laboratories (NYSE:ABT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

SUWIT NGAOKAEW/Shutterstock.com

How have hedgies been trading Abbott Laboratories (NYSE:ABT)?

Heading into the fourth quarter of 2016, a total of 52 of the hedge funds tracked by Insider Monkey were long this stock, a rise of 11% from the previous quarter. After suffering a steep fall during the fourth quarter of 2015, Abbott has steadily been attracting hedge funds as shareholders during the three quarters since. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ric Dillon’s Diamond Hill Capital has the largest position in Abbott Laboratories (NYSE:ABT), worth close to $502.2 million, comprising 3.1% of its total 13F portfolio. Sitting at the No. 2 spot is Richard S. Pzena of Pzena Investment Management, with a $212.2 million position. Remaining hedge funds and institutional investors with similar optimism include James Dondero’s Highland Capital Management, Dmitry Balyasny’s Balyasny Asset Management, and Doug Silverman and Alexander Klabin’s Senator Investment Group.