Shares of formal wear retailer The Men’s Wearhouse, Inc. (NYSE:MW) came under pressure recently, after the company unexpectedly ousted its founder and Executive Chairman, George Zimmer. Zimmer was the founder and the face of the company over the past four decades, best known for his tagline, “You’re going to like the way you look. I guarantee it.”

The company offered no formal explanation regarding the termination, and abruptly postponed its annual shareholder meeting scheduled for June 19, to “re-nominate the existing slate of directors without Mr. Zimmer.” This strange turn of events now has investors questioning the future of The Men’s Wearhouse, Inc. (NYSE:MW), which has been undergoing a steady turnaround under CEO Douglas S. Ewert.

However, I believe that we should calm down and examine all the facts first.

The leader or the face?

Although George Zimmer was the Executive Chairman of the board, it is unclear how much weight his decisions have with the company he founded in 1973. Zimmer served as the CEO of the company until 2011, until Ewert, his personal choice for chief executive, succeeded him. At the time of his termination, Zimmer owned a 3.5% stake in the company, worth $67.45 million.

Zimmer and Ewert steadily grew revenue and stabilized the company’s bottom line through tough economic times. Under Zimmer, The Men’s Wearhouse, Inc. (NYSE:MW) expanded into large markets by taking advantage of lower real estate costs. It expanded into casual sportswear in the 1980s and started a tuxedo rental business in 2000.

In its most recent quarter, The Men’s Wearhouse, Inc. (NYSE:MW) reported a 23% year-on-year rise in earnings as revenue climbed 5.1% to $615.5 million. The company’s top and bottom line growth, which it attributed to an earlier Easter and prom season, comfortably topped Wall Street estimates.

Same-store sales rose 4.4% across the company. Its namesake formal wear stores posted a 7.1% gain, which was dragged down by a 2.8% decline at menswear retailer Moores and a 5.3% drop at K&G, which caters to men, women and children.

By comparison, the company’s primary rival, Jos. A. Bank Clothiers Inc (NASDAQ:JOSB), reported a 45.5% plunge in profit as revenue declined 2.6% to $196.1 million last quarter. Same-store sales plunged 8.5% from the previous year.

By all counts, The Men’s Wearhouse, Inc. (NYSE:MW) was pounding Jos. A. Bank Clothiers Inc (NASDAQ:JOSB) into the ground. So what happened?

Is it time to slim down or buff up?

In March, Ewert announced that the company was exploring “strategic alternatives” for K&G, including a sale or spin off of the troubled business. According to an unidentified source at Bloomberg, this was a major source of tension between Ewert and Zimmer, who didn’t support selling the ailing business. Zimmer also reportedly questioned Ewert’s strategy of stock buybacks.

Based on these facts, I believe that Ewert wanted to slim down Men’s Wearhouse by focusing on its core competencies, and use the cash to appease shareholders, while Zimmer wanted to use that cash to turnaround and improve K&G instead.

However, the future looks increasingly bleak for K&G, which is an off-price retailer similar to Ross Stores, Inc. (NASDAQ:ROST). Off-price retailers such as K&G, Ross, and TJ Maxx utilize a strategy of buying off-season brand name items at steep discounts, putting them in storage, and then slowly rotating them into the store.

The problem is that K&G’s rivals are pulling this off more successfully, rendering K&G’s tiny footprint of 97 stores, which accounted for 11% of the company’s 2012 revenue, increasingly irrelevant. Ross Stores, Inc. (NASDAQ:ROST), for example, reported a 15.1% year-on-year increase in profit last quarter, while its revenue rose 7.8%. Same-store sales climbed 3%. Ross and its larger peer, TJ Maxx, are now as commonly associated with off-price retailing as Costco Wholesale Corporation (NASDAQ:COST) is with discount wholesale.

Men’s Wearhouse total operating expenses have risen 28.5% over the past four years, which could explain this conflict over the future of the company. Should it slim down by ditching K&G or buff up by renovating its stores?

Zimmer issued a statement to CNBC, stating that the company “has inappropriately chosen to silence” these concerns by firing him. Over the past 40 years, Zimmer expanded Men’s Wearhouse from a single Texas store to 1,143 locations across North America.

A fresh new approach?

Meanwhile, some market researchers and analysts are debating the future public image of Men’s Wearhouse. Will the company continue using the image of George Zimmer, who is featured prominently in advertising, or will they introduce a new spokesman for a younger demographic?

Branding expert Eric Gustavsen, from Graj + Gustavsen, believes that using an older spokesman like Zimmer has distinct advantages and disadvantages. He refers to Dos Equis’ “Most Interesting Man in the World” as an advertising campaign centered on an older spokesman that works.

Yet he also mentions Old Spice, which ditched its grizzled old sailor in favor of younger models to reach out to a younger generation. Gustavsen notes, “There’s a tipping point between being aspirational and just being old or irrelevant.”

In my opinion, Zimmer’s image was well suited for his purpose. I think abandoning his image would turn Men’s Wearhouse into just another anonymous retailer. If the company tries to go the hip route with a younger spokesman, it could come off as condescending, in sharp contrast to Zimmer’s words of fatherly advice. Stifel analyst Richard Jaffe notes that Men’s Wearhouse will retain the legal rights to Zimmer’s image and over 500 hours of his video footage, should the company choose to keep its existing ad campaign.

The Foolish bottom line

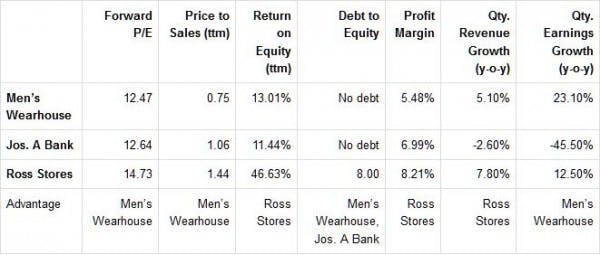

Let’s brush all that drama aside for a moment to compare the fundamentals of Men’s Wearhouse to its two aforementioned rivals – Jos. A Bank and Ross Stores – to better understand how the company is faring.

Source: Yahoo Finance, 6/20/2013

Fundamentally, Men’s Wearhouse is an attractively valued stock, trading at a lower forward P/E and P/S ratio than either rival. It also has a clean balance sheet and the strongest year-on-year earnings growth of the bunch.

Ross definitely has a strong advantage in margins and sales growth, but it only directly competes with Men’s Wearhouse’s K&G stores. Lastly, it’s clear that Men’s Wearhouse is very good at maintaining its core competencies, handily beating down its only publicly traded competitor, Jos. A Bank, in nearly every category.

Therefore, with or without its iconic founder, I still “like the way” Men’s Wearhouse looks. There’s no real reason to abandon this stock, which as already risen 30% over the past twelve months, when it has so many clearly defined strengths.

Leo Sun has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

The article I Still “Like The Way” This Retailer Looks originally appeared on Fool.com and is written by Leo Sun.

Leo is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.