The housing market has been recovering well lately. People have started spending on new homes as builders have begun to build new houses and apartments at a higher annual rate of 896,000 for the month of July.

Also, there has been a lot of optimism among U.S. homebuilders as demand for new homes increases. Confidence among homebuilders is at an eight-year high, as reported by the Wells Fargo builder sentiment index.

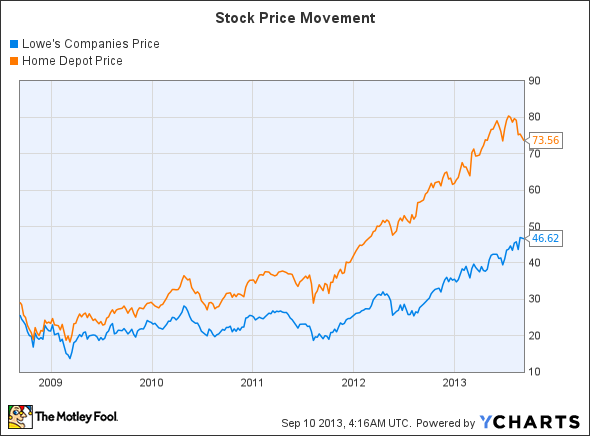

A quick look at the stock-price movement of these two companies in the last two years will give a better picture of how both retailers have recovered from the effects of the economic slowdown.

Both of the retailers have been growing steadily, especially The Home Depot, Inc. (NYSE:HD). The company reported its recent quarter, which witnessed a 9.5% increase in its top line and a jump of 17% in its bottom line as customers spent more money. Also, shoppers bought more bigger-ticket items, which drove revenue higher. This enabled the home-improvement retailer to raise its earnings outlook for the year to $3.60 per share, along with a sales growth of 4.5%.

However, Lowe’s Companies, Inc. (NYSE:LOW) has been performing well too, trying to bridge the gap with its largest competitor. Its recent quarter was a great example wherein it beat analysts’ expectations. Its same-store sales growth, a key metric to gauge a retailer’s performance since it ignores the effect of stores opened or closed during the period, was pretty impressive at 9.6%. This was quite close to The Home Depot, Inc. (NYSE:HD)’s metric for the quarter, which stood at 10.7%.

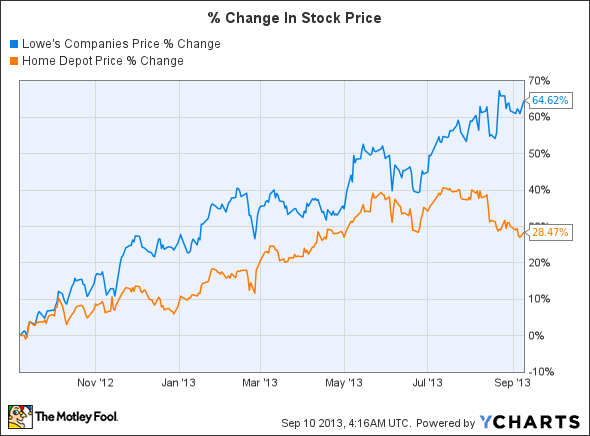

Also, if we look at the stock price appreciation in the last year, Lowe’s Companies, Inc. (NYSE:LOW) outperformed The Home Depot, Inc. (NYSE:HD). Its return to investors was double that of its competitor, as highlighted in the chart below.

Lowe’s Companies, Inc. (NYSE:LOW) key strategy of offering the lowest price possible seems to be working really well, driving revenue higher by 10.3% to $15.7 billion and pushing earnings up by 26% to $941 million. Also, it has been offering permanently low prices on many items across its stores, which attracted a lot of customers.

The road ahead

Lowe’s also plans to grow and expand its reach through a number of moves, such as hiring more workers and improving its inventory. It has been focusing on its product lines in order to offer the best-suited products to its customers. Resetting areas of its stores might also lure in new customers.

Moreover, the home-improvement retailer declared that it plans to open 10 new stores during the fiscal year. Also, Lowe’s Companies, Inc. (NYSE:LOW) will be acquiring 72 new stores from Orchard Supply Hardware. Orchard Supply Hardware is based in California, and Lowe’s is looking to increase its presence in that particular market with this acquisition. This will not only provide a great growth opportunity for Lowe’s, but will also help it better compete with The Home Depot, Inc. (NYSE:HD), since the latter already has a strong presence in the region.

In spite of all the positives, such as increasing demand, an improving housing sector, and growing companies, there is a matter of concern for these retailers. Rising mortgage rates might be a deterrent to the growing demand for housing sales and home improvement retailers.

Final thoughts

There has been a steady growth in demand, and people have started spending on their homes more than before. Additionally, these companies have been growing continuously and expect further growth, as highlighted by their upgraded guidance.

Lowe’s Companies, Inc. (NYSE:LOW) boosted its earnings guidance for the fiscal year to $2.10 per share from $2.05 per share previously, which reflects optimism by the company. Lowe’s strategies have been working well, and the company is trying harder than ever to compete with The Home Depot, Inc. (NYSE:HD). I believe investing in this company might prove rewarding in the months to come.

The article Home Depot or Lowe’s — Which Is a Better Pick? originally appeared on Fool.com and is written by Pratik Thacker.

Pratik Thacker has no position in any stocks mentioned. The Motley Fool recommends Home Depot.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.