Out of thousands of stocks that are currently traded on the market, it is difficult to determine those that can really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of over 700 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about The Hershey Company (NYSE:HSY).

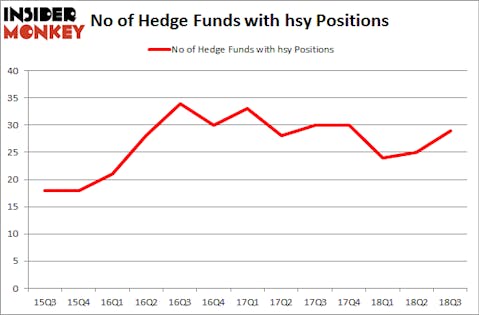

The Hershey Company (NYSE:HSY) was in 29 hedge funds’ portfolios at the end of September. HSY has seen an increase in support from the world’s most elite money managers of late. There were 25 hedge funds in our database with HSY holdings at the end of the previous quarter. Our calculations also showed that hsy isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Cliff Asness of AQR Capital Management

Let’s take a look at the recent hedge fund action surrounding The Hershey Company (NYSE:HSY).

What does the smart money think about The Hershey Company (NYSE:HSY)?

At the end of the third quarter, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of 16% from one quarter earlier. By comparison, 30 hedge funds held shares or bullish call options in HSY heading into this year. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in The Hershey Company (NYSE:HSY), which was worth $200.1 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $48.2 million worth of shares. Moreover, Millennium Management, Two Sigma Advisors, and Citadel Investment Group were also bullish on The Hershey Company (NYSE:HSY), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, specific money managers have jumped into The Hershey Company (NYSE:HSY) headfirst. Soros Fund Management, managed by George Soros, assembled the most valuable position in The Hershey Company (NYSE:HSY). Soros Fund Management had $17.3 million invested in the company at the end of the quarter. Clint Carlson’s Carlson Capital also made a $12.9 million investment in the stock during the quarter. The other funds with brand new HSY positions are Greg Poole’s Echo Street Capital Management, Jeffrey Talpins’s Element Capital Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s check out hedge fund activity in other stocks similar to The Hershey Company (NYSE:HSY). We will take a look at IHS Markit Ltd. (NASDAQ:INFO), Cerner Corporation (NASDAQ:CERN), Cintas Corporation (NASDAQ:CTAS), and Palo Alto Networks Inc (NYSE:PANW). All of these stocks’ market caps resemble HSY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INFO | 31 | 1334993 | 4 |

| CERN | 25 | 889948 | 3 |

| CTAS | 31 | 784446 | -3 |

| PANW | 46 | 2889148 | 4 |

| Average | 33.25 | 1474634 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.48 billion. That figure was $449 million in HSY’s case. Palo Alto Networks Inc (NYSE:PANW) is the most popular stock in this table. On the other hand Cerner Corporation (NASDAQ:CERN) is the least popular one with only 25 bullish hedge fund positions. The Hershey Company (NYSE:HSY) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PANW might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.