While most dividend paying stocks that trade on exchanges in the US pay quarterly, there are some stocks that pay their dividends on other schedules.

A handful pay their dividends semi-annually while a there is a larger population of monthly dividend stocks. While only one aspect that should be considered in selecting stocks for investment, monthly dividend payments can be advantageous for building wealth over time and to smooth out a dividend retirement income stream.

In my own personal portfolio, the largest portion of my stock holdings make dividend payouts in May, August, November, and February. I have to manage the family finances to ensure those quarterly payments last until the next quarter’s payments. If the majority of my holdings were monthly dividend stocks, it would be easier to manage the family’s cash flow.

As I inferred above, I and my family live off our investment income so I do not use a Dividend Reinvestment Plan (DRIP). We spend most of the investment income our portfolio generates. However, when I was working hard to build wealth, I did use DRIPs often to insure I had a systematic and disciplined investment strategy. There is a small benefit to be gained through monthly compounding in a DRIP versus quarterly compounding. Monthly compounding grows wealth just a little bit faster than quarterly compounding. The chart below provides that comparison.

The chart above shows the annual growth of $1.00 invested in a stock paying a 6% dividend for 25 years. On this scale it is hard to see much of a difference until the period between 20 and 25 years where the red and blue lines diverge.

To get a complete understanding of the benefit of monthly compounding, if you had an initial investment of $10,000 and had reinvested a 6% quarterly dividend (quarterly compounding) you would have $59,693 after 30 years. If the stock was instead a monthly dividend paying stock with the dividend reinvested, you would have $60,226 after 30 years. Every little advantage available should be exploited, especially in today’s market.

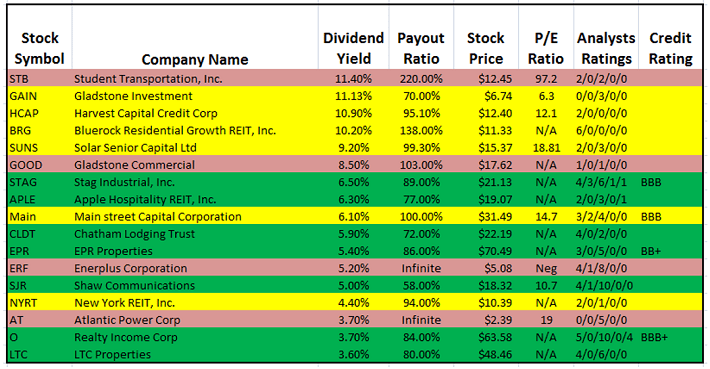

17 Monthly Dividend Stocks

You might be wondering why I chose 6% for the dividend rate when so few healthy companies are paying out dividends at that rate. The answer is that there are a number of companies out there that:

1. Pay dividends of 6% (plus or minus)

2. Are growing those dividends

3. Have solid balance sheets

A handful of these businesses even have investment grade credit ratings.

The table below provides a list of 17 monthly dividend stocks sorted on dividend yield.

It should be noted that this list is not all inclusive of monthly dividend paying stocks as there were a few monthly distribution paying master limited partnerships (MLPs) and a couple of crude oil production trusts that I chose to leave off this initial list of stocks.