U.S. utilities are in a rut and, according to recent energy projections, aren’t about to dig themselves out any time soon. But if you’re looking for a solid dividend with growth potential, you may find a match in U.S. utilities with international assets. I’ll highlight five utilities with different degrees of foreign forays and let you decide which fix fits your fancy.

America doesn’t want your energy

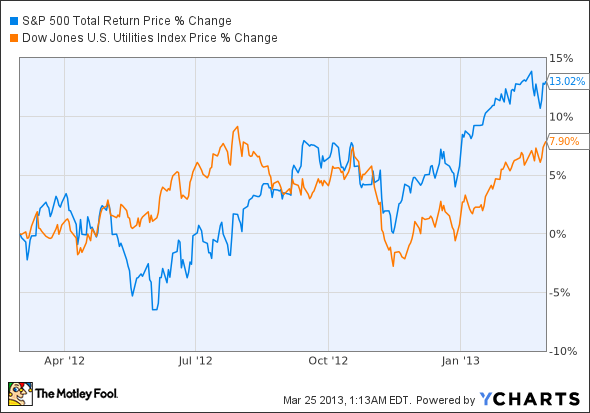

When Exelon Corporation (NYSE:EXC) CEO Chris Cane recently said “2012 was a difficult year on the economic front for our sector,” he wasn’t just making excuses for his company. Falling sales were a common trend for utilities last year, and the sector lagged the S&P 500 by more than 5 percentage points.

Looking ahead, projections aren’t peachy. A recent Department of Energy report predicts that electricity demand will clock in at 0.58% compound annual growth over the next decade, dulled by both America’s economy and advancements in energy efficiency.

The Federal Reserve announced last week that it expects U.S. GDP to fall between 2.9% and 3.7% by 2015, child’s play compared with many emerging markets. And although many utilities are overhauling their energy portfolios to set themselves up for a profitable future, some companies are looking abroad to propel top line growth.

Yes to The AES Corporation (NYSE:AES)?

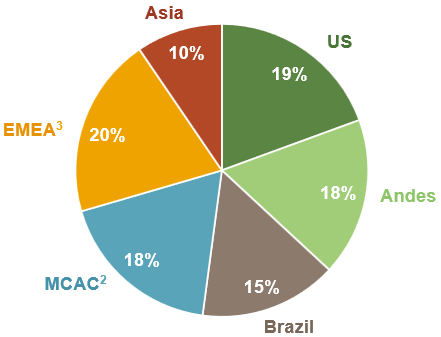

When looking for utilities with international exposure, The AES Corporation (NYSE:AES) is the elephant in the room. Its 27-country spread offers formidable international exposure.

Source: AES Earnings Presentation (MCAC is Mexico, Central America, and the Caribbean. EMEA is Europe, Middle East, and Africa)

But diversification doesn’t make bad business good, and The AES Corporation (NYSE:AES) is currently working to cut costs. Its 4.9 debt-to-equity ratio is higher than 98% of its peers, and the company’s decision to sell 14 assets in nine countries over the past year is no coincidence. The utility’s stock jumped 6% on solid Q4 earnings, and BRIC bulls would do well to give The AES Corporation (NYSE:AES) a closer look.

Feeling Chile?

Hailing from my home state, North Carolina-based Duke Energy Corp (NYSE:DUK) offers investors a nibble of internationalism with a big serving of Southern sauce. Its International Energy subsidiary is primarily focused on generation in Latin America, but it also owns a 25% stake in Saudi Arabian National Methanol Company. Duke Energy Corp (NYSE:DUK) axed a similar 25% stake in a Greek gas company in Q1 2012, while adding on a 240 MW thermal plant and 140 MW hydropower facility to its Chilean operations.

In total, Duke Energy Corp (NYSE:DUK) directly or indirectly generates 4,900 gross MW of international energy. That’s approximately 10% of the utility’s U.S. generation capacity, a significant slice of its portfolio pie. The utility beat top-line and earnings estimates last quarter and could be ready for some serious growth with its $12 billion of modernization projects well under way.