That’s the reason I am bullish on the biggest cash generators in the S&P 500. In response to the 2008 financial implosion and ongoing economic uncertainty, the S&P 500 has accumulated record cash in the past four years.

Third-quarter earnings highlighted the cash-hoarding trend, where many companies continued to save instead of investing in growth, according to JP Morgan. This pushed cash balances up 14% from last year and on track to hit $1.5 trillion, both record levels.

But even though that big financial cushion is making the private sector feel more comfortable, companies will eventually loosen the purse strings and begin to spend. This is just a matter of pure growth. This growth could be organically or through acquisition, but capital spending on new products and markets is a great way to increase sales.

And when companies start to invest in growth, then savvy investors will benefit.

Besides product and market acquisitions, companies withlots of cash can also buy back shares. This has been a very popular move this year, with many cash-rich companies announcing additional buybacks to reward investors.

A big cash balance can also trigger a special dividend. Whole Foods Market, Inc. (NASDAQ:WFM) and Costco Wholesale Corporation (NASDAQ:COST), for example, announced special dividends in the past month to incentivize shareholders and juice its share price.

Though hoarding cash seems to be popular these days, looking forward, cash-heavy companies are going to be sitting pretty when it’s time to be aggressive again.

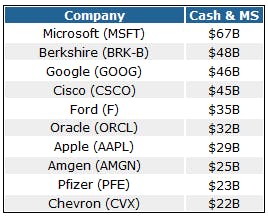

These 10 companies (excluding financials) had the highest cash balances at the end of the third-quarter, but only three stand out as my favorite stocks to profit from when these companies start spending again.

1. Microsoft Corporation (NASDAQ:MSFT)

Market cap: $230 billion

Cash on hand: $67 billion

Microsoft has been trapped in the ultimate range trade for the past 12 years, spending 90% of its time oscillating between $25 and $30. But that’s actually normal for a blue chip with a heavy $230 billion market cap. But this stagnant share price belies the company’s still very dominant position in many markets. Make no mistake, Microsoft still earns plenty of money.

Shares trade at only 10 times projected earnings of $2.88 per share for 2012, a sharp discount to the 10-year average of 17 times earnings. And don’t forget, Microsoft has turned itself into a solid dividend payer with a very solid yield of 3.4%. That’s how the company is giving money back to shareholders. Microsoft will never be the highflier it once was, but it has settle into a stable stock that pays a nice dividend. The fact that it appears undervalue now is just the cherry on top.

2. Pfizer Inc. (NYSE:PFE)

Market cap: $168 billion

Cash on hand: $23 billion

This is another highflier from the 1990s, one of the top performers of the heady decade. But unlike Microsoft, shares have begun recovering 47% in the past two years and hit a new five-year high in October. Pfizer is benefiting from growing demand for health care products and services with an industry-leading portfolio of generic and branded drugs. With a $186 billion market cap, this is no small company. But its low valuation suggests more upside, trading at just 10 times projected 2012 earnings of $2.16 per share, a solid discount to the industry average of 14 times. And when you add in a 3.5% dividend, this is a mega cap with tons of cash to support future dividend growth.

3. Chevron Corporation (NYSE:CVX)

Market cap: $215 billion

Cash on hand: $22 billion

Chevron is one of the largest energy companies in the world with multiplebusinesses and a market cap of $215 billion. Unlike smaller energy companies, Chevron has traded strongly in the past two years, with shares up 24%, handily beating the S&P 500’s 15% return in the same period. Chevron is an earnings and cash-flow machine, pushing its cash and marketable securities balance to $22 billion. With full-year earnings for 2012 expected to come in at $12.13 per share, this is another mega cap with value. Chevron’s dividend yield is another reward for investors looking for more stability.

Risks to Consider: Too much cash on the balance sheet can be a drag if companies underinvest in growth. Although cash hoarding in the past two years has lifted cash balances to record highs, this trend has been driven by economic uncertainty and fear of bad times ahead.

Action to Take –> These 10 stocks have the biggest cash balances in the S&P 500, providing them with additional stability for economic uncertainty. But longer term, those big cash balances present an opportunity for investors to capitalize on future growth, dividend increase and special dividends.

This article was originally written by Michael Vodicka, and posted on StreetAuthority.