Ensemble Capital recently published its 2022 Q2 investor letter, a copy of which can be downloaded here. The fund lost nearly a third of its value this year and trails the S&P 500 Index. However, it posted positive annualized returns of 7% and 10% respectively over the last 3 and 5 years. To have a glimpse of its finest picks for 2022, check out the top 5 holdings of the fund.

Ensemble Investor’s letter Q2,2022 discussed the company Target Corporation (NYSE:TGT). As per the discussion the people in America are optimistic about their financial condition despite the concerns about resection. The spending habits changed from goods to services. It is evident from the May earnings report of Target Corporation (NYSE:TGT). It is an American-based department store chain with a market capitalization of $73.14 billion. The one-month return of Target Corporation (NYSE:TGT)is 5.43% while its 12-month returns declined to -39.53%. The stock had a closing price of $157.74 on July 22, 2022.

Here is what the fund specifically said about Target Corporation (NYSE:TGT):

“Speaking on their earnings call, Target’s CEO Brian Cornell said that spending on items such as kitchen appliances, TVs and outdoor furniture – products that consumers splurged on while stuck at home – has declined sharply. While they had expected there to be a shift from spending on goods to services as America exited pandemic lifestyles, they didn’t anticipate the speed and magnitude of the shift. On the other hand, they saw luggage sales grow by an astounding 50%, along with robust growth in “going out” categories such as sunscreen, beauty products, and even toys as families return to hosting large birthday parties for their children. So, despite Target seeing increasing foot traffic and higher spending overall, they got caught with the wrong inventory relative to what customers wanted to buy. What this means for investors is that it is incorrect to say that the consumer is weak, despite weakness in some consumer facing companies. Rather what people are spending money on is changing rapidly, which is good or bad for a given company based on what they sell. Importantly, with demand shifting from items that were in short supply, there is good reason to think that inflation in these categories will moderate. Indeed, Target stated that their plan was to put their excess inventory on sale, something that consumers haven’t seen a lot of over the past two years. But as demand for COVID era goods moderates, demand for activities such as travel has surged, driving up inflation in airline tickets and hotel rooms. This illustrates the way that the shock waves from the pandemic have scrambled the typical economic cycle such that even at a time when all signs point to the biggest summer travel season in history, investors are worried that we are headed into, or are already in, a recession.”

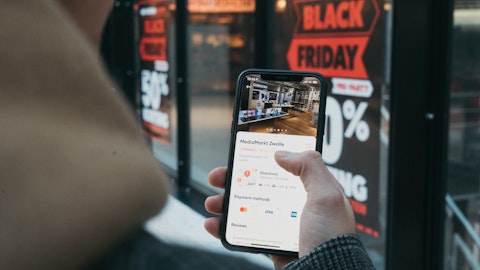

Photo by Franki Chamaki on Unsplash

Our calculations show that Target Corporation (NYSE:TGT) fell short and didn’t make it on our list of the 30 Most Popular Stocks Among Hedge Funds. Target Corporation (NYSE:TGT) was in 50 hedge fund portfolios at the end of the first quarter of 2022, compared to 49 in the previous quarter. Target Corporation (NYSE:TGT) shares lost 28% of their value over the last 52 weeks.

Recently we published another article and shared Michael Burry’s latest warning on the Bullwhip effect and its effects on Target Corporation (NYSE:TGT). You can find other investor letters from hedge funds and prominent investors on our hedge fund investor letters 2022 Q2 page.

Disclosure: None. This article is originally published at Insider Monkey.