Wedgewood Partners, an investment management company, released its first quarter 2023 investor letter. A copy of the same can be downloaded here. In the first quarter, Wedgewood Composite’s Net return was 9.8% compared to the Standard & Poor’s Index’s 7.5%, Russell 1000 Growth Index’s 14.4%, and Russell 1000 Value Index’s 1.0% return for the same period. In addition, you can check the top 5 holdings of the fund to know its best picks in 2023.

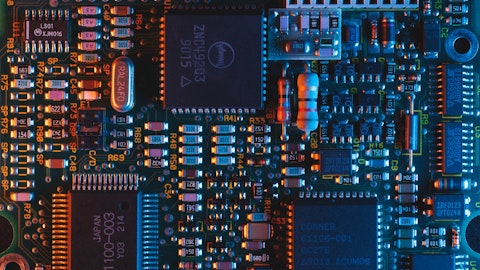

Wedgewood Partners highlighted stocks Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in the first quarter 2023 investor letter. Headquartered in Hsinchu City, Taiwan, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is an integrated circuit and other semiconductor device manufacturer. On April 14, 2023, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) stock closed at $87.20 per share. One-month return of Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) was -3.15%, and its shares lost 11.71% of their value over the last 52 weeks. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) has a market capitalization of $452.226 billion.

Wedgewood Partners made the following comment about Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in its Q1 2023 investor letter:

“Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) contributed to performance as revenues grew +27% (in USD) from the year ago quarter. Despite this strength, the Company’s customers have seen near-term weakness in demand due to Covid-19 normalization as well as the launch timing of new products. However, the Company is well-positioned to continue a long-term growth trajectory because its leading-edge capacity is being absorbed by high-performance computing applications, particularly at nontraditional integrated circuit (IC) design houses, such as Apple, Alphabet and Amazon, which have become IC-design powerhouses over the past decade. Importantly, the Company’s aggressive investment in leading-edge equipment, tight development with fabless IC designers, and embrace of open development libraries, should continue to foster a superior competitive position and attractive long-term growth.”

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 86 hedge fund portfolios held Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) at the end of the fourth quarter which was 87 in the previous quarter.

We discussed Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in another article and shared the list of best Warren Buffett stocks to buy according to hedge funds. In addition, please check out our hedge fund investor letters Q1 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 10 Best Education Stocks To Buy In 2023

- 11 Best 5% Dividend Stocks To Buy According To Analysts

- 10 Best Telecom Dividend Stocks To Buy for 2023

Disclosure: None. This article is originally published at Insider Monkey.