Yield seekers are driving up the prices of dividend stocks, thus suppressing yields. If you are one of those seeking better yields, you have to think differently to beat the crowd. This is especially true for those of you on fixed income, or expecting to be when you retire.

The Secret Ingredient

The secret ingredient most dividend investors are blind to is the potential for excellent dividend growth that’s sustainable over many years, if not decades. Dividend investors tend to have much longer time horizons than the average investor, but that dividend growth can make a huge difference sooner than you realize. It can also radically improve your retirement, as it has done for my parents and for my grandparents before them.

A Stark Comparison

To illustrate what dividend growth can do for you, let’s consider the five companies in the table below. It shows the stock price (as of June 15, 2013), dividend yield, and average annual dividend growth over the past 6.5 years. That takes us back to November 2006, well before the financial crisis.

StoneMor Partners L.P. (NYSE:STON) is a master limited partnership (MLP), a type of business known for its high yields. France Telecom SA (ADR) (NYSE:FTE) has an unusually high yield for such a large company, for reasons I’ll elaborate on in a moment. Chevron Corporation (NYSE:CVX), Intel Corporation (NASDAQ:INTC), and Microsoft Corporation (NASDAQ:MSFT) are all big stalwart companies with typically lower yields.

Without any due diligence beyond looking at a company’s yield, you might trot right over to your broker and buy shares of StoneMor Partners L.P. (NYSE:STON) and France Telecom SA (ADR) (NYSE:FTE). But here’s the rub: StoneMor Partners L.P. (NYSE:STON)’s dividend has barely kept pace with inflation, while France Telecom SA (ADR) (NYSE:FTE)’s dividend has actually fallen. Worse, France Telecom SA (ADR) (NYSE:FTE)’s dividend is high because it’s share price has been wasting away for years. Some may call that a buying opportunity, but the price is down because of fears the dividend will fall further. Buyer beware!

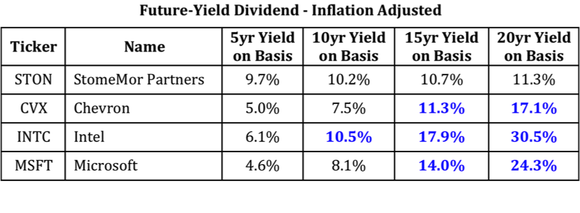

Assess the Dividend Growth

Let me now expand my table to include the future yield on your basis for the four companies whose yields have a future. This is the future dividend as a percent of your original cost basis. Let’s look at the yields 5, 10, 15, and 20 years out. I’ll also assume 2% inflation to keep the results in today’s dollars. Over time, the fast growing dividends (Chevron Corporation (NYSE:CVX), Intel Corporation (NASDAQ:INTC), Microsoft Corporation (NASDAQ:MSFT)), even those originally with lower yields, leave the placid growers (StoneMor Partners L.P. (NYSE:STON)) in the dust. Time is the friend of the smart dividend investor. Make time your friend.