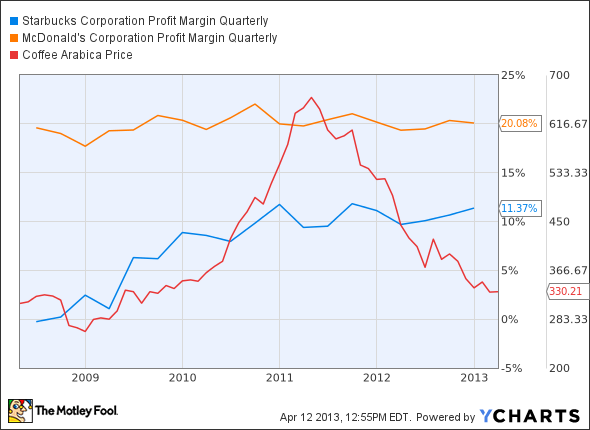

More importantly, Starbucks has demonstrated pricing power in an industry notoriously reliant on the cost of commodity foodstuffs. When coffee bean prices rose, Starbucks managed to increase its store prices, and from the look of things, it did so beyond the cost of the coffee. When coffee prices fell again, Starbucks held the line — and its new, fatter margins:

SBUX Profit Margin Quarterly data by YCharts.

While McDonald’s hasn’t seen margins deteriorate, they have weakened slightly, which is not a trend you want to see out of any globe-spanning restaurateur. On the other hand, Starbucks’ margins have never been higher. If coffee prices go back up, Starbucks already knows it can raise prices and justify itself to consumers, and consumers will pay up.

I just don’t see Starbucks Corporation (NASDAQ:SBUX) losing its touch any time soon. That’s why I’m giving it a thumbs-up as well. It may not grow as rapidly as it has exiting the last recession, but it should easily beat the market for years to come. You can read more about my reasoning by clicking here.

Travis’ take

I’ll admit that I’m one of the few people in the U.S. who doesn’t drink coffee and has rarely stepped foot into a Starbucks. But that doesn’t mean I don’t appreciate what Starbucks has built and how it plans to grow in the future.

Sean laid out the company’s strategy nicely, and Alex gave a fundamental reason the stock is a buy, but I’ll look at Starbucks from a more emotional level. After all, coffee is an emotional drink. It wakes drinkers up in the morning and has some sort of soothing effect I’ll never fully understand, bringing consumers back time and time again. This creates an emotional connection with the flavor, ambiance, and experience that is Starbucks and generates consistent returns for shareholders.

So when I looked at Starbucks Corporation (NASDAQ:SBUX)’ stock, I looked at it from a brand perspective. Somehow, Starbucks has managed to evolve and adapt as tastes and consumer demands have changed. It’s making home brew systems, tea offerings, and even other healthy drinks. The company has a way of changing with the times, and it all comes back to the brand that is Starbucks.

It’s hard to define the value of a brand, but if we look at the history of brands such as The Coca-Cola Company (NYSE:KO), NIKE, Inc. (NYSE:NKE), McDonald’s, and The Walt Disney Company (NYSE:DIS), we can see that they create a staying power. There will be ebbs and flows in the business, but for investors buying for the long term, a brand acts as a moat keeping competitors out.

In my detailed look at Starbucks earlier this week, I pointed to Caribou Coffee as an example of a company that couldn’t get past the Starbucks brand. The product is arguably just as good and definitely more creative (if you like that kind of thing), but even in Caribou’s backyard at the University of Minnesota and Minnesota-based Target Corporation (NYSE:TGT), Starbucks is king.

We could argue P/E ratios and margin trends all day, but I’m giving Starbucks a thumbs-up because I think it has the brand and the management to be a stock you can buy and forget about for a decade. That’s exactly the kind of stock I’m looking for.

The final call

I hope you’ve had your coffee for the day, because that would indeed the very rare unanimous CAPScall of outperform. The interesting aspect of our deeper dive into Starbucks is that we all see value in the company, yet from different angles. Travis doesn’t even drink coffee yet understands the branding and adaptation value that Starbucks can offer. Alex, an avid coffee drinker, approached Starbucks from a fundamental standpoint and saw a company with amazing pricing power and robust margins. I (Sean) angled my outperform call based on Starbucks’ past, present, and future growth strategies, noting that it’s a leader in innovation, emulation, and collaboration. Added together, that’s a pretty convincing case for a long-term outperform CAPScall.

The article Analysts Debate: Is Starbucks Still a Top Stock? originally appeared on Fool.com is written by Sean Williams, Alex Planes, and Travis Hoium.

Fool contributors Sean Williams, Alex Planes, and Travis Hoium have no positions in any companies mentioned here. You can follow Sean at @TMFUltraLong, Alex on Twitter at @TMFBiggles, and Travis at @FlushDrawFool.The Motley Fool owns shares of McDonald’s, Nike, Starbucks, Walt Disney, and Whole Foods Market and recommends Coca-Cola, Green Mountain Coffee Roasters, McDonald’s, Nike, Starbucks, Walt Disney, and Whole Foods Market.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.